LONDON, Oct. 23, 2017 /CNW/ - Meridian Mining SE (TSX V: MNO) ("Meridian " or the "Company") today provided an update on exploration results from its Bom Futuro tin joint venture in the state of Rondônia, in NW Brazil.

PROJECT BACKGROUND

The Bom Futuro tin mine has produced 195,000t of tin over a thirty-year history of continuous operation since its discovery in 1987. Meridian Mining entered a joint venture with the project owners - Coopersanta – in late 20161. The initial priority has been to evaluate opportunities to recover tin from the millions of cubic meters of tailings which have accumulated around the Bom Futuro Hill. The appreciation of the tin price in recent years has created a more favourable climate for assessing retreatment scenarios (current LME Cash buyer $US 20,925/t, from historical lows of $US3,625 in September 2001).

| ________________________ |

|

| 1 |

Details of the agreement are summarised in the Company's announcements of Dec. 19, 2016; March 16, 2017. |

HIGHLIGHTS

- Positive discussions with JV partners Coopersanta have expanded the area subject to the mining services agreement. The total area of tailings basins now allocated to Meridian for retreatment is 1,261 ha. Extensions to the southern palaeochannel system in the Central Area have also been included.

- Drilling continues on the tailings with two percussion rigs in operation. Site visit undertaken by resource consultancy H&S Consulting in preparation for resource estimation, with the objective of publishing the maiden resource and PEA in the current quarter.

- Further geophysical surveys have been undertaken around the perimeter of the Central Area, identifying new palaeochannel drill targets.

- Percussion drilling will be ongoing on the newly allocated target areas to the end of the year. The new geophysical targets will be prioritized for testing after the conclusion of the resource drilling.

"The expansion of the areas allocated under the mining services agreement reflects confidence that improved processing techniques can add value under our partnership," said Anthony Julien, President and CEO of Meridian. "Palaeovalley mineralization has made a significant contribution to the historical production at Bom Futuro, Brazil's second largest tin mine. The addition of the palaeovalley extensions offers scope to test for significant tonnages of mineralized material beyond the large tailings areas now allocated to the project."

MERIDIAN TAILINGS EVALUATION PROGRAM

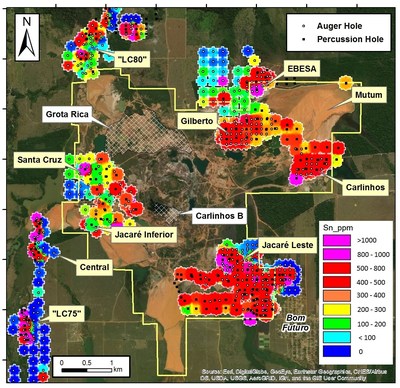

The tailings evaluation program originally commenced with 437 auger holes completed in the first quarter of 2017, targeting 493ha of allocated tailings basins at Jacaré Leste, EBESA, and the Santa Cruz corridor. Following the due diligence period, a program of percussion drilling has continued. Two rigs are currently in operation and a program of metallurgical testwork is progressing. The joint-venture partners, Coopersanta, have allocated additional tailings basins under the mining services agreement, expanding the total area of allocated tailings now to 1,261 ha (Fig 1).

The current percussion drilling program is focussed on testing the tailings basins on a 200 x 200m pattern, with 216 holes completed to date. The program is defining coherent areas of more elevated grades, typically in the range of 450 - 800ppm at Jacaré Leste, EBESA, Carlinhos and, Gilberto (Fig 1). The western tailings basins remain under drill definition. Highlights from the drilling include:

- EBESA: 7m @ 1,704ppm Sn

- Jacaré Leste: 17m @ 834ppm Sn

- Gilberto: 13.7m @ 891ppm Sn

- Carlinhos: 12m @ 913ppm Sn

- Santa Cruz: 29m @ 428ppm Sn

Drilling is currently in progress along Santa Cruz corridor and will then continue over the newly allocated areas. The current objective is to complete the broad-spaced drilling over the key basins this year for definition of an Inferred Resource and Preliminary Economic Assessment. A site visit has been undertaken by resource consultancy H&S Consultants in preparation for the estimation process.

ADDITIONAL ALLOCATION AREAS FOR PLACER MINERALIZATION

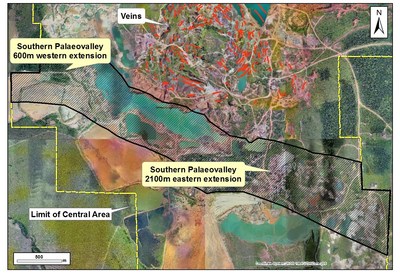

Discussions with the cooperative also focussed on unlocking value for inactive areas that can be revisited with improved recoveries. The extensions of the southern palaeochannel trend have been nominated for inclusion in the mining services agreement (Fig 2).

Mining of the Bom Futuro palaeochannels commenced in 1991, with activity peaking on the southern channel system from 2006 to 2012. The channels are characterized by higher grade basal gravel horizons which can contain >4-5 Sn kg/m3, and broader lower grade packages of sands which can run between 270 - 800 g/m3. The extensions of the southern channel system have never been drilled and provide a broad exploration footprint. The unconsolidated palaeochannel material is considered to offer synergies with tailings retreatment scenarios under evaluation.

GEOPHYSICAL PROGRAM

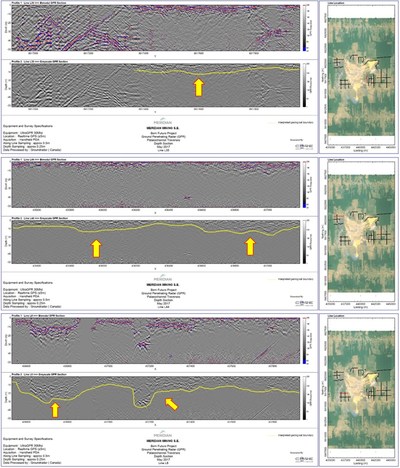

Exploration for additional palaeochannels and channel extensions has continued through an expansion of Meridian's ground penetrating radar (GPR) program. Orientation studies in the first quarter showed a clear signature of bedded sediments along known palaeochannel trends. An additional 30 line-kilometres of GPR surveys has tested for channel positions outside the perimeter of the Central Area. Erosion of the mineralised veins of the Bom Futuro Hill is expected to have contributed to the sediment bedload in these areas.

The recent program has successfully defined new targets positions where the GPR response provides a signature consistent with bedded unconsolidated sediments.

Geophysical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit. The Company commence a regional reconnaissance exploration drilling program following the conclusion of the tailings evaluation to screen targets for the presence of placer mineralization.

Examples of the GPR response and channel targets are illustrated in Figure 3.

Next Steps

- Percussion drilling will be ongoing on the newly allocated target areas to the end of the year.

- Resource evaluation will commence shortly with the objective of publishing the maiden resource and PEA in the fourth quarter.

On behalf of the Board of Directors of

Meridian Mining SE

"Anthony Julien"

Anthony Julien

President, CEO and Director

QUALIFIED PERSON

The technical information about the Company's exploration activity has been has been prepared under the supervision of and verified by Dr Adrian McArthur (B.Sc. Hons, PhD. FAusIMM), the Chief Geologist of Meridian Mining, who is a "qualified person" within the meaning of National Instrument 43-101.

ABOUT MERIDIAN

Meridian Mining SE is focused on the acquisition, exploration, development and mining activities in Brazil. The Company is currently focused on exploring and developing the Espigão manganese project, the Bom Futuro tin JV area, and adjacent areas in the state of Rondônia. The Company employs a two-pronged strategy with the objective of growing pilot production while advancing a parallel multi-commodity regional exploration program. Meridian is currently producing high grade manganese at its project located at Espigão do Oeste.

Further information can be found at www.meridianmining.co.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements include, among others, statements with respect to the Company's plans for exploration and development of its properties and potential mineralization. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such risk factors include, among others, failure to obtain regulatory approvals, failure to complete anticipated transactions, the timing and success of future exploration and development activities, exploration and development risks, title matters, inability to obtain any required third party consents, operating hazards, metal prices, political and economic factors, competitive factors, general economic conditions, relationships with strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices and one-time events. In making the forward-looking statements, the Company has applied several material assumptions including, but not limited to, the assumptions that: (1) the proposed exploration and development of mineral projects will proceed as planned; (2) market fundamentals will result in sustained metals and minerals prices and (3) any additional financing needed will be available on reasonable terms. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

The Company cautions that it has not completed any feasibility studies on any of its mineral properties, and no mineral reserve estimate has been established. In particular, because the Company's production decision relating to BMC's manganese project is not based upon a feasibility study of mineral reserves, the economic and technical viability of the Espigão manganese project has not been established.

The TSX Venture Exchange has in no way passed upon the merits of the proposed Arrangement and has neither approved nor disapproved the contents of this news release. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

NOTES

Meridian ratified a joint venture agreement with Coopersanta in March following a three-month due diligence period. The Company is evaluating tailings reprocessing scenarios in allocated areas, and is exploring for primary / palaeochannel targets in a 2000ha "Central Area", and a 18000ha "Unexplored Area". Details of the agreement are summarized in market releases of December 19, 2016 and March 16, 2017.

The drilling campaign commenced in Q1 2017 with a mechanical auger drilling program. The subsequent percussion drilling program is being conducted with a self-managed Sondeq SS5 and Bucyrus Erie hammer percussion rigs. Samples are collected in 1m intervals, weighed, dried, composited to 3m intervals and divided by riffle splitter to produce a 5kg sample. Samples are pulverized at the company's sample preparation facilities in Espigao do Oeste, with one pulp sent for provisional analysis by pressed powder XRF at the Coopersanta laboratory at Bom Futuro using a Rigaku X-ray spectrometry (XRF). Final assays are determined through ALS Global at Lima, Peru. Tin in analysed via lithium borate fusion and ICP-MS (1-10000 ppm detection range). Checks on higher-grade samples (>1000ppm) are conducted by lithium metaborate - lithium tetraborate flux with XRF Finish (method code XRF-15b). Certified reference materials and field duplicates are submitted as part of a quality control program. Tin grades quoted and illustrated in this report are those reported by the ALS Global.

Ground Penetrating Radar survey were conducted using Groundradar's proprietary UltraGPR technology (30Mhz system). Survey post-processing has been conducted by Groundradar Inc., and sectional interpretation has been conducted by Core Geophysics.

SOURCE Meridian Mining S.E.

Jonathan Richards, T: +1 (604) 802-4447, E: [email protected]

Share this article