Most drivers incorrectly believe comprehensive coverage means their car insurance policy covers them for everything

TORONTO, Sept. 1, 2020 /CNW/ - RATESDOTCA finds the majority of Canadian drivers scored an 'F' on a recent nationwide auto insurance literacy survey, meaning that they may be at risk of overpaying for premiums or worse, be underinsured. The survey asked seven common questions that drivers consider when securing vehicle insurance and found on average almost three (2.6) out of seven questions were answered correctly, with 9 per cent of Canadians incorrectly answering every statement.

Here are some of the surprising results:

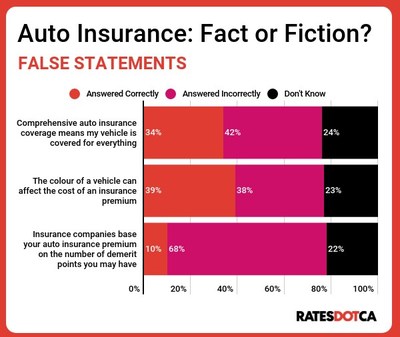

- Forty-two per cent incorrectly believe that comprehensive vehicle insurance covers everything (34 per cent knew this is false; 24 per cent did not)

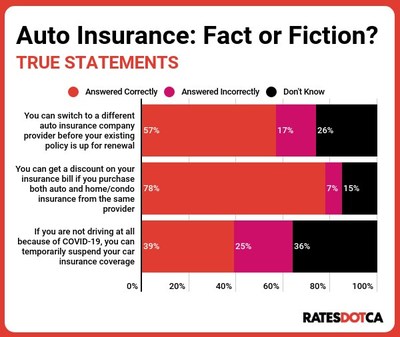

- Twenty-five per cent did not think they can temporarily suspend their car insurance if they are not driving during the COVID-19 pandemic (39 per cent of Canadians correctly knew they can; 36 per cent say they did not know)

- Nearly seven in 10 drivers (68 per cent) incorrectly believe that insurance companies base premiums on the number of demerit points a driver has (just 10 per cent answered right; 22 per cent did not know)

- Thirty-eight per cent think the colour of a vehicle influences the cost of insurance (it does not)

- Most respondents (79 per cent) think an expensive or high-end car costs more to insure than an economically priced vehicle (8 per cent do not and 13 per cent did not know). High-end cars are typically more expensive to insure than less expensive vehicles although, this isn't always the case

More comforting to learn was that 78 per cent of Canadians knew that they can receive a discount on their insurance bill if they bundle their auto and home/condo insurance and more than half (57 per cent) are aware they can switch auto insurance provider before their policy is due for renewal.*

"As Canadian drivers, the more we understand about auto insurance, the more likely we will get the coverage we need at a fair price and avoid disappointment when filing a claim for damages," says Liam Lahey, Insurance Editor, RATESDOTCA. "For example, although the name may be confusing, comprehensive insurance is an optional coverage you can add to your policy. It covers damages resulting from certain risks or perils such as theft, vandalism, and falling or flying objects but does not cover damages resulting from a collision."

Auto insurance can be confusing and difficult to understand. To help Canadians, Lahey offers these tips to Canadians who want to learn more about their auto insurance policies:

- Talk to your broker or insurance agent and ask to review your policy. Have them explain all the details of your coverage and ask if there are any gaps in your coverage or any discounts that you may be eligible for

- Take advantage of free, trustworthy sources online that clear up common misconceptions

- Whether your auto insurance policy is due for renewal or not, use an online comparison tool to shop around for policies and premiums from different insurers

The survey's findings also reveal: In some cases, the older, the wiser

- Forty-six per cent versus 34 per cent of Canadians under the age of 55 are more likely to know the colour of a vehicle has no bearing on the cost of an insurance premium

- Canadians aged 55 or older (63 per cent) are more likely to know they can switch providers before their policies are up for renewal compared to those under the age of 55 (53 per cent)

- Eighty-three per cent of drivers 55 and older are significantly more likely to be aware they can get a discount for bundling home and auto policies than people under the age of 55 (74 per cent)

- Men (61 per cent versus 52 per cent of women), Quebeckers (58 per cent versus 55 per cent rest of Canada) and a policy's primary driver (64 per cent versus 44 per cent of occasional or secondary drivers) were significantly more likely to correctly separate insurance facts from myths on three or more of the quiz's statements

To review the survey's findings, visit RATESDOTCA.

About the Survey

An online survey of 1,513 Canadians was conducted by Leger Marketing from August 7 to 10, 2020, using Leger's online panel. The sample's ages ranged from 18 to 55+ years old. The margin of error for this study is +/-2.5%, 19 times out of 20.

*Answers from respondents in Manitoba and Saskatchewan, which have public insurance regimes, were excluded from two of the seven questions that did not apply to them.

About RATESDOTCA

RATESDOTCA is Canada's leading rate comparison website that offers a quick and simple digital experience to compare the widest selection of insurance and money products in the market. Get a better rate on car, home, and travel insurance, mortgage, and credit cards all in one location. RATESDOTCA aims to help Canadians make better insurance and money decisions so they can save time and money to spend on what really matters to them. @RATESDOTCA

SOURCE RATESDOTCA

or to arrange an interview, please contact: Tracy Truong, Proof Inc. for RATESDOTCA, [email protected], (416) 602-7072; Cameron Penner, Proof Inc. for RATESDOTCA, [email protected], (416) 969-2705

Share this article