TORONTO, Nov. 1, 2018 /CNW/ - Desert Lion Energy Inc. (TSXV: DLI) (OTCQB: DSLEF) ("Desert Lion" or the "Company") is pleased to report the results of the Company's Preliminary Economic Assessment ("PEA") for its Namibian Lithium project ("Project"). The PEA covers mining, concentrate and lithium carbonate production. The PEA was prepared by independent consultants, Hatch Ltd ("Hatch") and The MSA Group (Pty) Ltd. ("MSA").

Highlights:

- Cash cost of lithium carbonate of US$4,080/ tonne and lepidolite (lithium) concentrate of US$141/ tonne, in each case including byproduct credits

- Initial direct capital costs of US$275 Million for mine, concentrator and lithium carbonate conversion plant, including by-product circuits (including a contingency of US$43 Million (15%))

- Low capital intensity for lithium carbonate of $13,750/ annual tonne of production of battery grade lithium carbonate

- US$144 Million pre-tax NPV (8% discount rate)

- 29% pre-tax Internal Rate of Return

- Payback period of ~2.5 years

- Life of Mine Revenues of US$852 Million

- Average sales price of US$13,000 per tonne of lithium carbonate

Cautionary Note: A PEA is preliminary in nature and includes Inferred Mineral Resources, which are considered too geologically speculative to have economic considerations applied to them that would enable them to be categorized as Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that the reserves development, production and economic forecast on which the PEA is based will be realized.

Tim Johnston, CEO of Desert Lion commented, "We are very pleased with the results of the Preliminary Economic Assessment which confirm management's belief in the benefits associated with the Project's at or near surface mineralization, proximity to high quality existing infrastructure and the low-cost operating environment in Namibia. The Preliminary Economic Assessment demonstrates the compelling economics of the Project, highlighted by low capital costs, low operating costs and high earnings."

The Preliminary Economic Assessment details the production of lepidolite (lithium) concentrate at the mine site with final processing of such concentrate into battery grade lithium carbonate near the Port of Walvis Bay. The mine site is located approximately 20 km from the town of Karibib and approximately 220 km from the major Port of Walvis Bay connected via the national highway and state-owned railway. The vertically integrated plant encompasses the development of a mine, concentrator and lithium carbonate plant capable of producing 20,000 tonnes per year of battery grade lithium carbonate. By-products include 35,250 tonnes of petalite concentrate per year and 290 tonnes of tantalum concentrate per year. The development plan will continue to be assessed during the next stage of work to be completed by the Company which is planned to include further exploration results and an assessment of the lithium market conditions.

Vertically Integrated Lithium Carbonate Plant

- 20,000 tonnes per year of battery grade lithium carbonate from an average of 2.35 million tonnes per year of run of mine mineralization, using conventional processing equipment

- Capital cost of US$275MM for mine, concentrator and lithium carbonate conversion plant, including by-product circuits, including contingency

- Average cash cost of production US$4,080/ tonne of battery grade lithium carbonate, net of byproducts and inclusive of royalties

- Life of Mine Revenues of US$852 Million

- US$144 Million pre-tax NPV at an 8% discount rate (US$109 Million post-tax), assuming an average sale price of lithium carbonate of US$13,000/ tonne

- 29% pre-tax Internal Rate of Return (25% post-tax)

- Payback period of ~2.5 years

- Future exploration potential and project life extension provides an opportunity for further economic upside

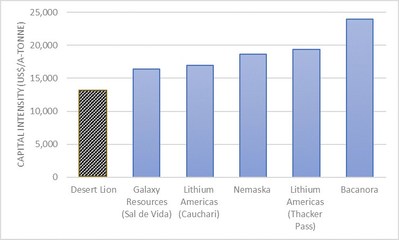

The capital cost for the Desert Lion Lithium Project is amongst the lowest of lithium development peers. Figure 2 shows the relative capital intensity of the Desert Lion Vertically Integrated project compared to peers.

Notes:

- Capital costs and planned production has been collected from publicly available information as of 30 October 2018

- Desert Lion Energy has completed a Preliminary Economic Assessment on its project in Namibia

- Lithium Americas has completed a Pre-Feasibility Study on its Cauchari project in Argentina

- Each of Galaxy Resources, Nemaska, Bacanora and Lithium Americas (in respect of its Thacker Pass project in Nevada) have completed a Feasibility Study in respect of their projects and operations.

Cautionary Note: A PEA is preliminary in nature and includes Inferred Mineral Resources. The other projects presented in the above table are at a PFS or FS stage of development which imparts a higher confidence in the economic and technical feasibility of operations. Accordingly, readers should not place undue reliance on such information.

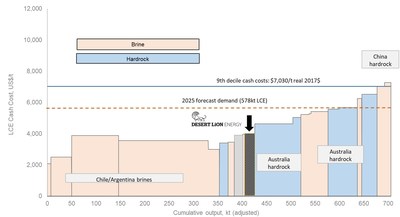

In addition, the operating cost for the Desert Lion Lithium Project is amongst the lowest in the world. Figure 3 shows the relative cash operating cost net of byproducts and inclusive of royalties for integrated or potential for integrated lithium projects (source: Morgan Stanley).

Cautionary Note: Desert Lion Energy has completed a PEA which is preliminary in nature and includes Inferred Mineral Resources. The other projects presented in the above table are at various stages of development, including PFS or FS stage of development, which imparts a higher confidence in the economic and technical feasibility of operations. Accordingly, readers should not place undue reliance on such information.

Qualified Persons

The PEA was prepared by Hatch Ltd. and The MSA Group (Pty) Ltd., companies independent from Desert Lion. Robert Duinker, P.Eng, MBA, Marianne Utiger, P.Eng., Gary Fowler, QP. and Blaire Mackenzie, M.Eng, CPEng, P.Eng. of Hatch Ltd. all Qualified Persons according to NI 43-101 have reviewed and approved the technical information pertaining to the economic estimates in this news release. In accordance with the National Instrument 43-101 Standards of Disclosure for Mineral Projects, which supports the MRE and PEA, the PEA Report will be filed on SEDAR within 45 days from this date.

About Desert Lion Energy

Desert Lion Energy is an emerging lithium development company focused on building Namibia's first large-scale lithium mine to be located approximately 210 km from the nation's capital of Windhoek and 220 km from the Port of Walvis Bay. The Company's Rubicon and Helikon mines are located within a 301 km2 prospective land package, with known lithium bearing pegmatitic mineralization. The project site is accessible year-round by road and has access to power, water, rail, port, airport and communication infrastructure.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget" "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved." Forward-looking information includes but is not limited to statements and expectations regarding: the targeted additional deposits within the Company's mining and exploration licences; PEA economics; the potential for the results to support an economical project; and the Company's planned work program for the Project and its exploration and development schedule and timetable. Forward-looking information is based on certain factors and assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, lithium and other metal prices, the estimation of initial and sustaining capital requirements, the estimation of labour and production costs, the estimation of mineral resources, assumptions with respect to currency fluctuations, the timing and amount of future exploration and development expenditures, receipt of required regulatory approvals, the availability of necessary financing for the Project, permitting and such other assumptions and factors as set out herein.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in lithium prices; sources and cost of power and water for the Project; the estimation of initial capital requirements; the lack of historical operations; the estimation of labour and operating costs; general global markets and economic conditions; risks associated with exploration, development and operations of mineral deposits; the estimation of initial targeted mineral resource tonnage and grade for the Project; risks associated with uninsurable risks arising during the course of exploration, development and production; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support exploration activities; risks associated with changes in the mining regulatory regime governing the Company and the Project; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at the Project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of the Company; the risk of litigation.

Although the Company has attempted to identify important factors that cause results not to be as anticipated, estimated or intended, there can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is made as of the date of this presentation and the Company does not undertake to update or revise any forward-looking information this is included herein, except in accordance with applicable securities laws.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of Mineral Resources will be converted to Mineral Reserves.

Inferred Mineral Resources are based on limited drilling which suggests the greatest uncertainty for a resource estimate and that geological continuity is only implied. Additional drilling will be required to verify geological and mineralization continuity and there is no certainty that all of the Inferred Resources will be converted to Measured and Indicated Resources.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

SOURCE Desert Lion Energy

Desert Lion Energy Inc., Tim Johnston, CEO, Tel: (416) 309-2953, Email: [email protected]

Share this article