Equinox Gold Announces Updated Feasibility Study for Los Filos Expansion

Mineral Reserves Increased 44% to 5.4 Million Ounces of Gold

360,000 Ounces of Average Annual Gold Production from 2025-2030

Mine Life Extended to 14.5 Years with 280,000 Ounces of Average Annual Gold Production

NPV5% of $625 million and IRR of 26% at $1,675/oz Gold

all dollar figures in US dollars, unless otherwise indicated

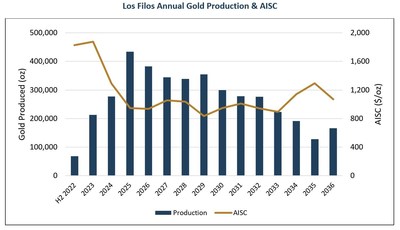

VANCOUVER, BC, Oct. 19, 2022 /CNW/ - Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) ("Equinox Gold" or the "Company") is pleased to announce the results of a Feasibility Study for an expansion at the Company's 100%-owned Los Filos Mine Complex ("Los Filos") located in Mexico. Current Los Filos operations consist of both run-of-mine ("ROM") and crushed ore heap leach facilities. With continued development of the Bermejal Underground deposit and construction of a 10,000 tonnes per day ("t/d") carbon-in-leach ("CIL") processing plant, the Los Filos mine life would be extended to 14.5 years with life-of-mine ("LOM") average annual production increasing to 280,000 ounces ("oz") of gold (2023-2036) at all-in sustaining costs1 ("AISC") of $1,081 per oz. Total LOM production is estimated at 3.97 million oz of gold. Peak production during 2025-2030 averages 360,000 oz of gold per year. Using the base case $1,675/oz gold price, the expansion project has an after-tax net present value discounted at 5% ("NPV5%") of $625 million with an internal rate of return ("IRR") of 26%.

Gold mineralization at Los Filos extends beyond the drilled area, and it is expected that additional drilling along the contact between intrusive and carbonate rock could identify further skarn mineralization. With exploration success and conversion of Mineral Resources to Mineral Reserves, considerable potential exists to extend the Los Filos mine life beyond 2036.

- After-tax NPV5% of $625 million at base case $1,675/oz gold

- After-tax IRR of 26% at $1,675/oz gold

- 5.4 million oz gold of Proven and Probable Mineral Reserves

- 7.9 million oz gold of Measured & Indicated Resources (exclusive of Reserves)

- 3.97 million oz LOM gold production

- 360,000 oz peak average annual gold production (2025-2030)

- 280,000 oz average annual gold production LOM (2023-2036)

- 1.22 million oz of gold produced from the heap leach with average recovery of 55%

- 2.75 million oz of gold produced from the CIL plant with average recovery of 88%

- 11.83 million oz LOM silver production

- $993 million after-tax LOM cumulative net cash flow

- $981/oz average LOM cash costs1

- $1,081/oz average LOM AISC1

- $318 million initial capital cost to build the CIL plant and associated infrastructure

- 14.5-year mine life with extension potential from Mineral Resource conversion and exploration success

_________________________________________ |

1. Cash costs and all-in sustaining costs are non-IFRS measures. See Non-IFRS and Other Financial Measures. |

The Feasibility Study includes an updated Mineral Reserve and Mineral Resource estimate incorporating a revised mine plan and 101,407 metres of exploration drilling since October 31, 2018. Factoring 681,000 oz of mining depletion over almost four years, Los Filos Mineral Reserves have increased 44% over the 2018 estimate, with 193.2 million tonnes ("Mt") of Proven & Probable Mineral Reserves grading 0.86 grams per tonne ("g/t") gold for 5.4 million oz of contained gold. An additional 325.3 Mt of Measured & Indicated Mineral Resources (exclusive of Mineral Reserves) grading 0.75 g/t gold for 7.9 million oz of contained gold, and 135.9 Mt of Inferred Mineral Resources grading 0.74 g/t gold for 3.2 million oz of contained gold demonstrate the potential for mine life extension with successful conversion of Mineral Resources to Mineral Reserves. Refer to the detailed Mineral Reserve and Mineral Resource tables that follow in this news release.

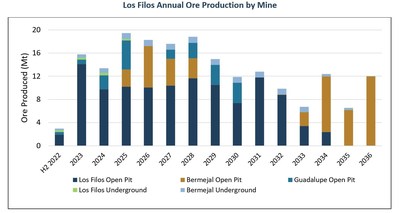

Los Filos encompasses three main open-pit mining areas: Los Filos, Guadalupe and Bermejal, and three underground mines: Los Filos South, Los Filos North and Bermejal Underground. Bermejal Underground development recommenced in Q2-2021 and the deposit has been contributing higher-grade ore since mid-2022. Ore from all six mining areas is currently processed on heap leach pads.

The Feasibility Study contemplates construction of a CIL plant commencing in 2023 with an 18-month timeline for construction and commissioning, which would allow higher-grade ore to be directed to the CIL plant commencing in mid-2024. While the economic and production estimates outlined in the Feasibility Study and in this news release are predicated on that timeline, Equinox Gold has not approved construction for the CIL plant.

Greg Smith, President & CEO of Equinox Gold, commented: "The Feasibility Study confirms a path to expand Los Filos to a large-scale, long-life gold mine with a substantial reserve and resource endowment and opportunity for further growth. We are pleased with the results of the Feasibility Study; however, we have not made a decision to proceed with the expansion. Any decision to proceed with the Los Filos expansion will be made considering the operating stability in the region, market conditions and availability and cost of capital. Equinox Gold is currently focused on construction of its Greenstone Mine in Ontario, Canada, and advancing the permitting to expand its Castle Mountain Mine in California, USA."

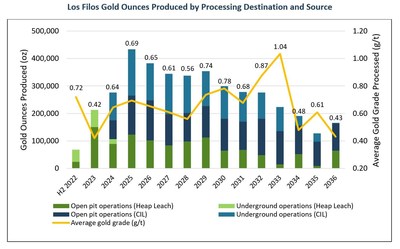

Los Filos has produced 3.4 million oz of gold since the mine commenced operations in 2005, with ore from all deposits processed using heap leach facilities. The Feasibility Study contemplates building and operating a 10,000 t/d CIL processing plant to operate concurrently with the existing heap leach facilities. All underground ore and higher-grade open-pit ore (generally above 0.5 g/t gold) would be directed to the CIL plant, with lower-grade ore going onto the heap leach pads as either crushed or run-of-mine stacked ore. Ore that contains higher levels of copper and sulphur would also be directed to the CIL plant to optimize the economic recovery of gold from all ore types.

Constructing and operating the CIL plant, compared to a heap leach only scenario, extends the Los Filos mine life by approximately four years and adds more than 1.1 million ounces of gold to LOM production.

Gold price (base case) |

$1,675/oz |

Exchange rate (Mexican Peso to US Dollar) |

20:1 |

Average annual gold production (LOM) (2023-2036) |

280,000 oz |

Peak average annual gold production (2025-2030) |

360,000 oz |

Total gold production (LOM) |

3.97 million oz |

Heap leach facilities |

1.22 million oz |

CIL plant |

2.75 million oz |

Proven & Probable Mineral Reserves |

5.35 million oz |

Gold grade (open pit 0.65 g/t, underground 3.94 g/t) |

0.86 g/t |

Measured & Indicated Mineral Resources (exclusive of Mineral Reserves) |

7.90 million oz |

Gold grade (open pit 0.71 g/t, underground 3.65 g/t) |

0.75 g/t |

Open-pit strip ratio |

4.4:1 |

Average gold recovery (heap leach / CIL) |

55% / 88% |

Ore stacked on heap leach (average over LOM) |

28,000 t/d (10 Mtpa) |

CIL plant throughput |

10,000 t/d (3.65 Mtpa) |

Initial mine life (commencing H2 2022) |

14.5 years |

Initial capital costs for CIL plant construction |

$318 M |

Non-sustaining capital (including capitalized stripping) (LOM) |

$400 M |

Sustaining capital (LOM) |

$349 M |

Cash costs (LOM, including royalties) |

$981/oz |

AISC (LOM) |

$1,081/oz |

Net cumulative cash flow (LOM, after tax) |

$993 M |

NPV5% (after tax) |

$625 M |

IRR (after tax) |

26 % |

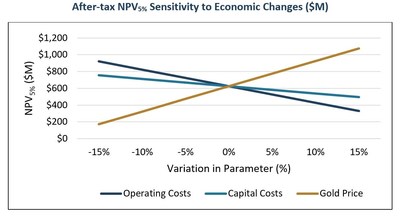

Using the base case gold price of $1,675/oz and incorporating only Proven & Probable Mineral Reserves, the expansion project has an after-tax NPV5% of $625 million and an after-tax IRR of 26%. The expansion project economics are most sensitive to fluctuations in the gold price, followed by changes in operating costs and capital costs. Approximately 40% of capital costs for the expansion project are priced in Mexican Pesos.

After-tax NPV5% Sensitivity to Economic Changes ($M)

Variation in Parameter |

Operating Costs |

Capital Costs |

Gold Price |

−15% |

920 |

755 |

172 |

−10% |

822 |

712 |

323 |

−5% |

724 |

668 |

474 |

0 % |

625 |

625 |

625 |

5 % |

526 |

582 |

776 |

10 % |

427 |

538 |

926 |

15 % |

328 |

495 |

1,076 |

Initial capital costs for construction of the CIL plant are estimated at $318 million, which is included in total LOM non-sustaining capital of $718 million. Closure and reclamation costs of $51 million are also included in non-sustaining capital. LOM sustaining capital is estimated at $349 million.

Item |

Non-Sustaining |

Sustaining |

Total |

Open pit mobile equipment and workshop upgrade |

125 |

133 |

252 |

Los Filos Open Pit - capitalized stripping |

112 |

- |

112 |

Bermejal Open Pit - capitalized stripping |

77 |

- |

77 |

Guadalupe Open Pit - capitalized stripping |

- |

44 |

44 |

Los Filos Underground development |

- |

16 |

16 |

Bermejal Underground development |

35 |

70 |

106 |

CIL plant |

318 |

- |

318 |

Heap leach pad expansion |

- |

86 |

86 |

Closure and reclamation |

51 |

- |

51 |

Total |

718 |

349 |

1,067 |

Note: Numbers may not sum due to rounding. |

Total LOM operating costs are estimated at $4,015 million. Approximately 83% of the LOM operating costs are related to mining and processing, with the remainder attributable to general and administrative costs, land access payments and social collaboration payments to local communities.

Item |

($M) |

$/oz |

Mining (Open pit and Underground) |

2,072 |

521 |

Open pit |

1,118 |

281 |

Underground |

954 |

240 |

Processing |

1,288 |

324 |

General and administrative, community, and land access |

655 |

165 |

Total operating costs |

4,015 |

1,010 |

Royalties |

34 |

9 |

Refining and transport |

22 |

6 |

Silver credits |

(172) |

(43) |

Cash costs |

3,899 |

981 |

Sustaining capital |

349 |

88 |

Reclamation costs |

51 |

13 |

AISC |

4,299 |

1,081 |

Note: Numbers may not sum due to rounding. |

The mine plan is based on Proven & Probable Mineral Reserves of 180.6 Mt grading 0.65 g/t gold for 3.8 million oz of contained gold in the open pit deposits, and 12.6 million tonnes grading 3.94 g/t gold for 1.6 million oz of contained gold in the underground deposits.

Classification |

Mining |

Tonnes |

Gold Grade |

Contained Gold |

Silver Grade |

Contained Silver |

Proven |

Open Pit |

35,154 |

0.74 |

837 |

5.0 |

5,677 |

Underground |

299 |

4.15 |

40 |

13.7 |

132 |

|

Total |

35,453 |

0.77 |

877 |

5.1 |

5,809 |

|

Probable |

Open Pit |

145,476 |

0.62 |

2,921 |

6.3 |

29,303 |

Underground |

12,297 |

3.94 |

1,556 |

18.9 |

7,458 |

|

Total |

157,773 |

0.88 |

4,477 |

7.2 |

36,761 |

|

Proven & |

Open Pit |

180,629 |

0.65 |

3,758 |

6.0 |

34,980 |

Underground |

12,597 |

3.94 |

1,596 |

18.7 |

7,590 |

|

Total |

193,226 |

0.86 |

5,354 |

6.9 |

42,570 |

Notes: Mineral Reserves have been estimated in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (2014), which are incorporated by reference in NI 43-101. The open pit Mineral Reserve estimate was prepared under the oversight and review of Mr. Eugene Tucker, P.Eng., and the underground Mineral Reserve estimate was prepared under the oversite and review of Mr. Paul Salmenmaki, P.Eng. Mr. Tucker and Mr. Salmenmaki are "Qualified Persons" as defined by NI 43-101. Mineral Reserves are estimated using a long-term gold price of $1,450 per troy oz and a long-term silver price of $18 per troy oz for all mining areas. Mineral Reserves are stated in terms of delivered tonnes and grade before process recovery. Mineral Reserves are defined by pit optimization and are based on variable break-even cut-offs as generated by process destination and metallurgical recoveries. Metal recoveries are variable dependent on metal head grades as outlined in the Technical Report. Open pit dilution is applied at 5% at a zero grade for Au and Ag for Bermejal Open Pit and Guadalupe Open Pit, and 7% at zero grade for Au and Ag for Los Filos Open Pit. Open pit mining recovery is applied at 95% for Bermejal Open Pit and Guadalupe Open Pit, and 93% for Los Filos Open Pit. Heap leach process recovery varies based on rock type. The Qualified Persons responsible for this item of the Technical Report are not aware of any mining, metallurgical, infrastructure, permitting or other relevant factors that could materially affect the Mineral Reserve estimates. Effective date of Mineral Reserves is June 30, 2022. Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces. Underground Mineral Reserves are reported based on a variable net processing return cut-off value varying between $65.8 and $96.6/t Underground dilution is assigned an average of 10% at a zero grade for gold and silver. Underground mining recovery is set to 97%. Numbers may not sum due to rounding. Additional details regarding the Mineral Reserve estimation, classification, reporting parameters, key assumptions and associated risks for Los Filos are provided in the Feasibility Study. In addition, Mineral Reserves and Mineral Resources may be materially affected by legal, political, environmental and other risks, including the factors identified in the Company's Annual Information Form dated March 24, 2022 for the year ended December 31, 2021. Both documents are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar. |

Area |

Classification |

Tonnes |

Gold Grade |

Contained Gold |

Silver Grade |

Contained |

Bermejal / Guadalupe |

Measured |

9,898 |

0.76 |

243 |

6.4 |

2,034 |

Indicated |

184,152 |

0.59 |

3,492 |

7.6 |

45,186 |

|

Measured & Indicated |

194,050 |

0.60 |

3,734 |

7.6 |

47,220 |

|

Inferred |

44,292 |

0.55 |

777 |

9.8 |

13,932 |

|

Bermejal Underground |

Measured |

- |

- |

- |

- |

- |

Indicated |

998 |

3.97 |

127 |

16.3 |

522 |

|

Measured & Indicated |

998 |

3.97 |

127 |

16.3 |

522 |

|

Inferred |

1,501 |

4.98 |

241 |

22.7 |

1,093 |

|

Los Filos Open Pit |

Measured |

35,327 |

1.09 |

1,238 |

6.4 |

7,315 |

Indicated |

90,544 |

0.79 |

2,290 |

6.5 |

18,857 |

|

Measured & Indicated |

125,870 |

0.87 |

3,528 |

6.5 |

26,172 |

|

Inferred |

87,552 |

0.68 |

1,914 |

7.7 |

21,657 |

|

Los Filos Underground |

Measured |

2,081 |

4.13 |

276 |

22.8 |

1,527 |

Indicated |

2,326 |

3.09 |

231 |

25.7 |

1,920 |

|

Measured & Indicated |

4,407 |

3.58 |

507 |

24.3 |

3,446 |

|

Inferred |

2,590 |

3.67 |

306 |

27.5 |

2,287 |

|

Total |

Measured |

47,306 |

1.15 |

1,757 |

7.2 |

10,876 |

Indicated |

278,020 |

0.69 |

6,140 |

7.4 |

66,485 |

|

Measured & Indicated |

325,326 |

0.75 |

7,897 |

7.4 |

77,360 |

|

Inferred |

135,935 |

0.74 |

3,237 |

8.9 |

38,969 |

Notes: Mineral Resources are exclusive of Mineral Reserves and have been estimated in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (2014), which are incorporated by reference in NI 43-101. The Mineral Resource estimate was prepared under the oversight and review of Mr. Ali Shahkar, P.Eng., a "Qualified Person" as defined by NI 43-101. Mineral Resources that are not Mineral Reserves do not have a demonstrated economic viability. Mineral Resources are reported to a gold price of $1,550/oz. Open pit Mineral Resources are defined within pit shells that use variable mining and recovery estimates depending on the geometallurgical domain and whether mineralization is projected to report to crush-leach or is considered typical run-of-mine for processing requirements. Open pit Mineral Resources are reported to a gold cut-off grade of 0.2 g/t. Open pit Mineral Resources use variable mining costs of $1.27-$1.43/t and variable processing costs of $3.40-$12.81/t. Recovery ranges from 50% to 85% depending on ore treatment method. Underground Mineral Resources use variable mining costs of $57.21-$93.12/t and variable processing costs of $9.53-$11.64/t, and a process recovery of 90%-95%. Underground Mineral Resources are reported to a gold cut-off grade: Los Filos South Underground, 1.71 g/t gold; Los Filos North Underground, 2.05 g/t gold; Bermejal underground 2.71 g/t gold. Quantity of material is rounded to the nearest 1,000 tonnes; grades are rounded to two decimal places for gold, one decimal place for silver. Numbers may not sum due to rounding. Additional details regarding the Mineral Resource estimation, classification, reporting parameters, key assumptions and associated risks for Los Filos are provided in the Feasibility Study. In addition, Mineral Reserves and Mineral Resources may be materially affected by legal, political, environmental and other risks, including the factors identified in the Company's Annual Information Form dated March 24, 2022 for the year ended December 31, 2021. Both documents are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar. |

Open pit mining will remain owner-operated with conventional load, haul, drill and blast. Loading is currently undertaken by 250-tonne shovels and large front-end loaders, and haulage by 136-tonne trucks. A larger mining fleet composed mainly of 180-tonne electric-drive trucks and 400-tonne face shovels is proposed to progressively replace the existing mining equipment as it reaches the end of its useful life, accounting for $125 million of costs considered growth capital and $133 million of sustaining capital costs over the mine life. Over the estimated 14.5-year mine life, total open-pit material moved is estimated at 982.4 Mt, with 180.6 Mt of ore and 801.7 Mt of waste for an open-strip ratio of 4.4:1. The mine plan contemplates 34.8 Mt of open pit ore at an average grade of 1.53 g/t gold going to the CIL plant, 24.6 Mt at an average grade of 0.67 g/t gold going to crush heap leach and 121.2 Mt at an average grade of 0.39 g/t gold going to ROM heap leach, for total gold production from all open-pit sources of 2.56 million oz.

Mining methods for the underground deposits vary depending on the ore type and ground conditions. In the Los Filos Underground, mining methods include overhand cut and fill in narrow areas, overhand drift and fill in wider areas, and longhole open stoping in areas with vertical ore body continuity and good rock conditions. In the Bermejal Underground, oxide ore will be mined using overhand drift and fill, which constitutes the majority of the deposit, and underhand drift and fill will be used to mine ore in intrusive host rock.

Los Filos Underground production is expected to average 960 t/d until the end of its mine life in 2025. Bermejal Underground stope development with multiple headings is expected to advance by approximately 180 metres per month, which is equivalent to approximately 250 t/d per stope mining horizon. A second portal will provide two points of access by 2025, at which point Bermejal Underground is expected to operate at steady-state production of 2,740 t/d (1 Mt/a) from 2025 to 2032. Los Filos Underground mining is owner-operated. Bermejal Underground is mined by a contractor.

For its remaining mine life Los Filos Underground is expected to contribute 1.2 Mt of ore at an average grade of 3.50 g/t gold. Bermejal Underground is expected to contribute 11.4 Mt of ore at an average grade of 3.99 g/t gold. Underground ore will go to crush heap leach until the CIL plant is operating at which point all underground ore will be directed to the CIL plant, for total gold production from all underground sources of 1.41 million oz over the remaining 14.5-year mine life.

LOM mining costs are estimated at $1.38/t for open-pit mining, including capitalized waste stripping, and $75.70/t for underground mining.

Los Filos Annual Ore Production by Mine

The combined open pit and underground mine plan is focused on optimizing project value by allocating ore to ROM leach, crush leach or the CIL plant to optimize economic gold recovery. Since the metallurgical recovery and operating costs for each mined block of open-pit ore will be variable depending on rock type, sulphur grade, copper grade, and processing destination, daily ore control decisions (e.g., selecting the optimal processing destination) will be guided by mining software that determines the maximum profit for each block, rather than by a fixed cut-off grade. The combined mine plan results in a mine life that extends until 2036.

Los Filos Gold Ounces Produced by Processing Destination and Source

The LOM plan shows average recoveries of 55% from heap leach processing and 88% from the CIL plant. LOM production averages 280,000 oz per year commencing in 2023, with peak production averaging 360,000 oz per year from 2025-2030. LOM AISC averages $1,081/oz of gold sold. A substantial decrease in AISC from mid-2024 correlates with the increase in ounces produced as a result of the commissioning of the CIL plant.

Los Filos Annual Gold Production & AISC

Heap Leach

Two large geosynthetic-lined heap leach pads are in operation, divided into two sections, one for crushed ore and the other for ROM ore. ROM ore is currently stacked on Pad 1 and crushed ore on Pad 2. Pads 1 and 2 cover 2,515,000 m² and 721,000 m², respectively, for a total area of 3,236,000 m² . Stacked ore is fully leached after 120 days for crushed and 180 days for ROM ores.

Pregnant leach solution from the heap leach pads will continue to be processed in the existing ADR (adsorption, desorption and recovery) plant. The ADR plant is a conventional carbon-in-column adsorption facility associated with an elution circuit, carbon regeneration circuit and gold refinery that produces a gold-silver doré product.

As of June 2022, approximately 260 Mt of ore have been stacked on the heap leach pads. There is sufficient storage capacity for the LOM crushed ore on Pad 2; however, Pad 1 will not have enough storage capacity to store all the LOM ROM ore. A third pad (Pad 3) will be constructed at the southern end of Pad 2 to provide 63.5 Mt of additional storage for ROM ore. This new pad will be constructed in three phases, starting with the first phase in 2023. In addition to Pad 3, an "interliner" is proposed to be constructed on top of portions of Pads 1, 2 and 3 once the pads have been filled to their design capacity. The interliner will provide 82 Mt of additional storage capacity for ROM ore and CIL tailings. The interliner will be built in two phases, with the first phase required by 2031. Leach pad expansions account for $86 million of the LOM sustaining capital. The current and planned heap leach pad infrastructure will be sufficient to support mining operations for the LOM plan.

CIL Plant

The CIL plant design is based on a robust metallurgical flowsheet developed for optimum recovery, while taking into account capital costs and operating costs. As the CIL plant is an addition to an existing operation, existing site services (power, water, etc.) will be used, where appropriate, to supply the new facilities. The process of the new CIL plant includes crushing, milling, gravity, carbon in leach, carbon regeneration, thickening, and filtration of the CIL tailings for dry-stack storage. A second ADR plant will be built to recover gold from the loaded carbon of the CIL process.

Key project design criteria for the plant are:

- Capacity to treat 10,000 t/d (3.65 Mt/a) of varying blends of the main ore types as determined by the LOM production schedule

- Crushing plant utilization of 75% and CIL and tailings filtration plant utilization of 91.3%, supported by the incorporation of surge capacity and standby equipment where required

- The grinding plant will grind ores to P80 0.075 mm and leach them in a CIL circuit for 40 hours to extract an estimated 90.6% contained gold and 38.8% contained silver

- The grinding flowsheet includes gravity concentration

- Gold will be recovered from the loaded carbon in a 10-tonne batch ADR plant

- CIL plant tailings will be thickened, filtered and delivered by conveyors to a filtered tailings storage facility

Overall processing costs are estimated to average $7.76/t for crush heap leach, $2.85/t for ROM heap leach and $13.25/t for CIL processing. As with most gold ore processing plants, the three largest cost components are cyanide, grinding media and power.

A total of 45.7 Mt of tailings will be generated from fine grinding the various ores during the CIL process. The tailings will be filtered through a series of pressure filter presses to achieve a high degree of dewatering, with the resultant tailings cake disposed of in a filtered tailings storage facility on the eastern side of Pad 1, which is close to the planned location of the tailings filter plant.

The majority of infrastructure requirements for expansion at Los Filos are already in place, including heap leach facilities, an ADR plant, water storage and distribution, maintenance workshop, laboratory, site administration buildings, warehouse and workforce facilities. New infrastructure required includes the 10,000 t/d CIL plant, a new 40 MW electric substation, an extension of the 115kV high voltage transmission line to the new substation, an upgrade of the mobile equipment workshop, additional waste rock storage facilities, and an expansion of the heap leach pads.

Water usage for the Los Filos Mine Complex is currently 1.0 Mm3/a and the permit allows for 1.2 Mm3/a of extraction. An application to increase the water permit to 2.2 Mm3/a is in process.

Additional power will be required to operate the CIL plant. The current capacity of its existing electrical substation is 20 MW to satisfy a demand of up to 14 MW peak demand. The CIL plant will consume additional energy beyond the capacity of the existing substation; therefore, a larger, 40 MW substation is proposed to provide electrical energy to the expanded mine. An application was made to CENACE (Mexico's federal electricity commission utility) for the additional energy required, and CENACE completed a study to confirm energy availability and electrical infrastructure upgrades. The study will be updated once a final decision to advance the CIL plant is made.

As Los Filos is currently in operation, existing management, operating and maintenance labour will support the new CIL operations and maintenance teams. There is abundant skilled labour in the region. The Los Filos workforce is typically around 1,500 employees and contractors, drawn primarily from the nearby communities of Carrizalillo, Mezcala and Xochipala. Non-union personnel fill primarily administration and supervisory roles. Other roles, including maintenance, operators, and process plant personnel, are filled with union personnel or contractors. The underground and open pit operations personnel and ADR plant personnel operate on two shifts per day. The Feasibility Study contemplates the need for an additional 114 positions to support CIL plant operations.

Equinox Gold retained AMC Mining Consultants, Lycopodium Minerals Canada Ltd., Paul Sterling, and StruthersTech Technical Solutions Ltd. to jointly prepare with the Equinox Gold Technical Services group a Technical Report on Los Filos. The Technical Report provides an update of a previous study dated March 11, 2019. The Technical Report also provides an update on the ownership status of the project, Mineral Resources, Mineral Reserves and project economics.

The Qualified Persons ("QPs") are Gary Methven, P.Eng., of AMC Mining Consultants; Paul Salmenmaki, P.Eng., of AMC Mining Consultants; Mo Molavi, P.Eng., of AMC Mining Consultants; Eugene Tucker, P.Eng., of AMC Mining Consultants; Glenn Bezuidenhout, FSAIMM, of Lycopodium Minerals Canada Ltd.; Paul Sterling, P.Eng., independent consultant; Riley Devlin, P.Eng., of StruthersTech Technical Solutions Ltd.; and Kelly Boychuk, P.Eng., Ali Shahkar, P.Eng., and Travis O'Farrell, P.Eng., all of Equinox Gold. The Mineral Resource estimates were prepared by Equinox Gold geologists under the supervision of Ali Shahkar and were reviewed by AMC Mining Consultants prior to use for the Feasibility Study. The Mineral Reserves, mine plan and mining sections of the study were prepared by or under the supervision of AMC Mining Consultants. The metallurgical testwork, process design and process plant information were prepared by or under the supervision of Paul Sterling and Lycopodium Minerals Canada. The study is being summarized into a technical report that will be filed within 45 days on the Company's website at www.equinoxgold.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar, in accordance with National Instrument 43-101.

The technical content of this news release has been reviewed and approved by the QPs who were involved with preparation of the NI 43-101 Updated Technical Report for the Los Filos Mine Complex, Guerrero State, Mexico.

For readers to fully understand the information in this release they should read the technical report in its entirety when it is available on SEDAR, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read as a whole and sections should not be read or relied upon out of context.

Equinox Gold is a growth-focused Canadian mining company with seven operating gold mines, construction underway at a new project, and a clear path to achieve one million ounces of annual gold production from a pipeline of development and expansion projects. Equinox Gold operates entirely in the Americas with one property in Canada, two properties in the United States, one in Mexico and four in Brazil. Equinox Gold's common shares are listed on the TSX and the NYSE American under the trading symbol EQX. Further information about Equinox Gold's portfolio of assets and long-term growth strategy is available at www.equinoxgold.com or by email at [email protected].

Greg Smith, President and Chief Executive Officer

Rhylin Bailie, Vice President, Investor Relations

Tel: +1 604-558-0560

Email: [email protected]

Technical Information

Doug Reddy, M.Sc., P.Geo., Equinox Gold's Chief Operating Officer, and Scott Heffernan, M.Sc., P.Geo., Equinox Gold's EVP Exploration, are Qualified Persons under National Instrument 43-101 for Equinox Gold and have reviewed and approved the technical content of this document.

Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Disclosure regarding the Company's mineral properties, including with respect to mineral reserve and mineral resource estimates included in this news release, was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the "SEC") generally applicable to U.S. companies. Accordingly, information contained in this press release is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Non-IFRS and Other Financial Measures

This news release includes certain measures with no standardized meaning under International Financial Reporting Standards ("IFRS"), namely: all-in sustaining costs ("AISC"); cash costs; AISC per oz sold; and sustaining and non-sustaining capital expenditures. Such measures are "non-GAAP financial measures", "non-GAAP ratios", "supplementary financial measures" or "capital management measures" (as such terms are defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure). Equinox Gold believes these measures, while not a substitute for measures of performance prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to the information provided by other issuers. Please see the information under the heading Non-IFRS Measures in Equinox Gold's Management's Discussion and Analysis (MD&A) for the year ended December 31, 2021, which section is incorporated by reference in this news release for a description of the non-IFRS financial measures noted above. The MD&A may be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/EDGAR.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include future-oriented financial information. Forward-looking statements and forward-looking information in this news release relate to, among other things: the strategic vision for the Company and expectations regarding exploration potential, production capabilities and future financial or operational performance of Los Filos; the Company's ability to successfully advance its growth and development projects, including the expansion of the Bermejal underground and construction of the CIL Plant at Los Filos, the expansion at Castle Mountain and the construction of Greenstone; the Company's production and cost expectations; and the conversion of Mineral Resources to Mineral Reserves. Forward-looking statements or information generally identified by the use of the words "will", "continue", "expected", "potential", "estimate", "on track" and similar expressions and phrases or statements that certain actions, events or results "could", "would" or "should", or the negative connotation of such terms, are intended to identify forward-looking statements and information. Although the Company believes that the expectations reflected in such forward-looking statements and information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. The Company has based these forward-looking statements and information on the Company's current expectations and projections about future events and these assumptions include: Equinox Gold's ability to achieve the exploration, production, cost and development expectations for Los Filos and its other operations and projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and future cash requirements; prices for energy inputs, labour, materials, supplies and services; the Company's working history with the workers, unions and communities at Los Filos; no labour-related disruptions and no unplanned delays or interruptions in scheduled construction, development and production, including by blockade or industrial action; construction of Greenstone being completed and performed in accordance with current expectations; expansion projects at Los Filos and Castle Mountain being completed and performed in accordance with current expectations; Mineral Reserve and Mineral Resource estimates and the assumptions on which they are based; all necessary permits, licenses and regulatory approvals are received in a timely manner; tonnage of ore to be mined and processed; ore grades and recoveries; capital, decommissioning and reclamation estimates; and the Company's ability to comply with environmental, health and safety laws and other regulatory requirements. While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Accordingly, readers are cautioned not to put undue reliance on the forward-looking statements or information contained in this news release.

The Company cautions that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements and information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services; fluctuations in currency markets; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); inadequate insurance, or inability to obtain insurance to cover these risks and hazards; employee relations; relationships with, and claims by, local communities and indigenous populations; the Company's ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner or at all; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mining; risks relating to expropriation; increased competition in the mining industry; and those factors identified in the section titled "Risks and Uncertainties" in the Company's MD&A dated March 23, 2022 for the year ended December 31, 2021, and in the section titled "Risks Related to the Business" in the Company's Annual Information Form dated March 24, 2022 for the year ended December 31, 2021, all of which are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar. Forward-looking statements and information are designed to help readers understand management's views as of that time with respect to future events and speak only as of the date they are made. Except as required by applicable law, the Company assumes no obligation to publicly announce the results of any change to any forward-looking statement or information contained or incorporated by reference to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements and information. If the Company updates any one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements. All forward-looking statements and information contained in this news release are expressly qualified in their entirety by this cautionary statement.

SOURCE Equinox Gold Corp.

Share this article