Hold the phone: RBC gives clients the power to control their credit cards through the RBC Mobile app Français

Credit card controls allows RBC Mobile clients the freedom to lock and unlock their credit cards at their convenience, without having to call the Advice Centre

TORONTO, June 25, 2018 /CNW/ - We've all been there. You open your wallet and your credit card isn't where it should be. You mentally retrace your steps wondering if you left it in your car, the last store you visited, or if your toddler has "borrowed" it and left it in the toy box. RBC has introduced a new functionality through the RBC Mobile app to help clients who have misplaced their credit cards, without going through the hassle of ordering a new one.

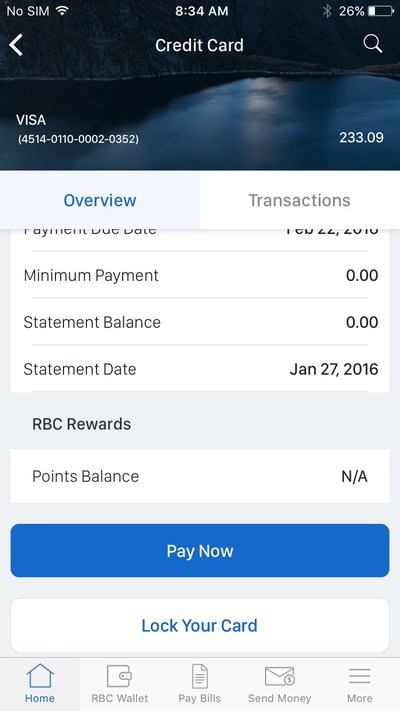

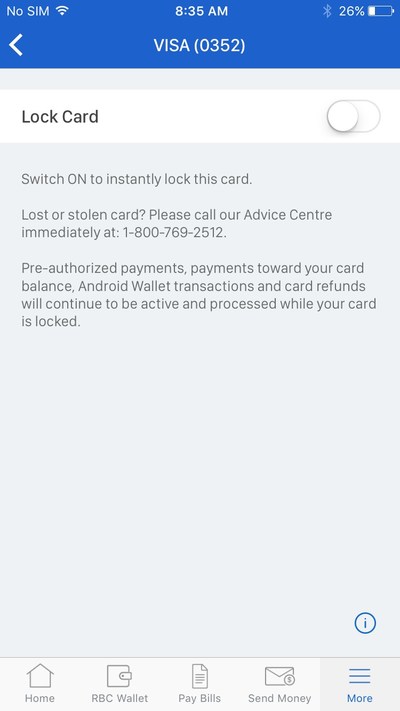

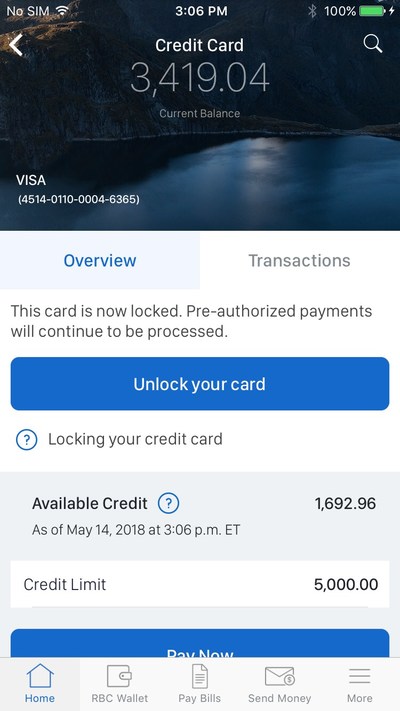

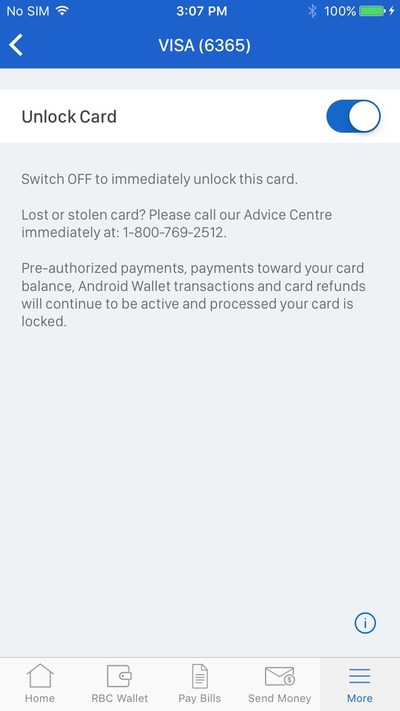

Credit card controls allows RBC Mobile clients to place or remove a temporary lock on their credit cards with a simple action. Clients can lock their card if they've misplaced it, or if they're travelling without it.

"We know that many of our clients who report their credit card as lost end up finding it, creating the inconvenience of having to wait for a replacement card," says Sean Amato-Gauci, Executive Vice President, Cards, Payments & Banking, RBC. "Client expectations are evolving, and credit card controls are another way we're making it easier for clients to do business with us. This new feature takes the stress out of misplacing your credit card, and helps our clients take their time to retrace their steps and find their card, while giving them peace of mind that their money is safely protected by RBC."

Credit card controls can be accessed through the RBC Mobile app. Clients simply log in and navigate to the account details page of the credit card they wish to place or remove a lock from. Temporary locks can be placed or removed with a simple action. While the credit card is locked, purchases and cash advances will be blocked, while payments, refunds and preauthorized charges such as subscriptions and bill payments will be processed as usual, giving clients peace of mind, and control over their card.

"We're using digital to better understand our clients and completely rethink how we can deliver services that make the day-to-day banking experience delightfully simple and convenient for our clients," says Peter Tilton, Senior Vice President, Digital, RBC. "We know that more than 85 per cent of our retail transactions are performed by clients in a self-serve channel, which is proof that our clients want digital solutions like credit card controls at their fingertips."

RBC is digitizing the everyday banking experience through the RBC Mobile app, which is why we provide a host of embedded value-added services to clients, such as credit card controls, our Siri capabilities, and NOMI Insights and NOMI Find & Save.

RBC leads the financial services industry with the best mobile banking experience in Canada. The RBC Mobile app has been rated #1 in customer satisfaction by J.D. Power and our clients for the second year in a row. We're also outperforming our Canadian peers across a range of key digital performance indicators, including digital sales and digital client retention.

RBC has seen an increase of 19 per cent in active mobile users over the past year, a clear indication that more Canadians are using the RBC Mobile app to bank whenever and wherever they want. In Q1 2018, our clients officially made mobile banking their primary digital channel for financial transactions.

The RBC Mobile app is available for free download from the App Store on iPhone, iPad or at www.AppStore.com, and Google Play on Android devices, or at play.google.com. For more information about the RBC Mobile app, please visit www.rbcroyalbank.com/mobile.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 81,000+ employees who bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada's biggest bank, and one of the largest in the world based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our 16 million clients in Canada, the U.S. and 34 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-sustainability.

SOURCE RBC Royal Bank

Media contacts: Heather Colquhoun, RBC Communications, 437-994-5044, [email protected]

Share this article