Namibia Rare Earths Inc. Provides Update on Agreement to Acquire Portfolio of Critical Metal Properties in Namibia and $500,000 Private Placement

- Agreement with Gecko Namibia (Pty) Ltd ("Gecko Namibia") to acquire a majority interest in seven projects ranging from exploration opportunities to near term feasibility stage

- Diversifies Namibia Rare Earths Inc.'s single commodity focus from heavy rare earths on the Lofdal project into a broader portfolio of critical metals and minerals crucial for electric vehicle industry including cobalt, lithium, graphite, tantalum, niobium, and gold

- Initial focus will be on cobalt project following discovery of stratabound cobalt-copper mineralization on neighboring license in northern Namibia

- Strategic partnership formed with mineral development and mining group, Gecko Namibia, strengthens operational capacities for mineral processing and mine development

- Pine van Wyk (NHD Met. Eng. B.Com, MBA), Managing Director of Gecko Namibia, will be appointed CEO of Namibia Rare Earths Inc.

- Gecko Namibia and Gerald McConnell, Chair of the Board of Namibia Rare Earths Inc, to complete CDN$500,000 private placement

HALIFAX, Dec. 8, 2017 /CNW/ - Namibia Rare Earths Inc. ("Namibia Rare Earths" or the "Company") (TSXV: NRE) today provided an update on its progress towards completing the acquisition of a portfolio of critical metal properties (the "Properties") from Gecko Namibia (Pty) Ltd. ("Gecko Namibia") in consideration for the issuance of 64,000,000 common shares of Namibia Rare Earths ("Property Acquisition") and on its progress towards completing a $500,000 private placement ("Private Placement") both of which were announced in the Company's press release of November 10, 2017. Pursuant to the policies of the TSX Venture Exchange (the "Exchange"), the Company is required to issue a news release every 30 days following its initial news release to provide an update on the status of the Property Acquisition.

The Company is focused on the regulatory process to obtain the consent of the Exchange for the Property Acquisition and the Private Placement. Exchange conditional approval of the Property Acquisition was obtained on November 17, 2017 and the Company is working to fulfill all conditions for final approval.

In accordance with the policies of the Exchange, the Namibia Rare Earths shares are currently halted from trading and it is expected that they will remain halted until receipt and review of acceptable documentation regarding the Property Acquisition, pursuant to Exchange listings Policy 5.3.

Property Acquisition and Private Placement

Namibia Rare Earths has entered into an agreement with Gecko Namibia to acquire its 95% interest in a portfolio of exploration properties consisting of 14 exploration prospecting licences ("EPLs") four of which are pending, one mineral deposit retention licence ("MDRL") and Gecko Namibia's rights under an option agreement to acquire a 60% interest in a further exploration prospecting licence which interest may, subject to the terms of the option agreement, be increased to 80%.

This transaction provides Namibia Rare Earths with a high quality, diversified portfolio of critical metals and at the same time has secured a highly experienced strategic partner. Gecko Namibia and its subsidiaries are substantial participants in the Namibian resource sector with 327 employees and a proven track record in the mining industry. The Gecko Namibia portfolio of properties will expand the Company's commodity base from solely rare earths to a variety of highly critical commodities including cobalt, copper, zinc, lithium, graphite, tantalum, niobium, nickel, and gold. Ground holdings in Namibia will increase from 221 km2 (Lofdal) to over 6,850 km2.

In conjunction with the Property Acquisition, Gecko Namibia and Gerald J. McConnell, Chair of the Board of Namibia Rare Earths, have each agreed to complete a private placement with the Company in the amount of $250,000 at $0.05 per share for total gross proceeds to the Company of $500,000 ("Private Placement"). A total of 10,000,000 common shares of Namibia Rare Earths will be issued pursuant to the Private Placement. The Private Placement is subject to the approval of the TSXV.

The Property Acquisition and Private Placement are expected to close on or before January 31, 2018 and are subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval and acceptance by the TSXV. Upon completion of the Property Acquisition and Private Placement, Gecko Namibia will own 69,000,000 common shares of the Company representing 43.75% of the outstanding common shares of the Company. The Property Acquisition is conditional upon receipt of the approval of shareholders as required by the TSXV which has been obtained.

The proceeds of the Private Placement will be used to carry out work on the properties acquired from Gecko Namibia with an initial focus on advancing the Kunene cobalt-copper project and to fund general corporate requirements. The common shares of the Company issued pursuant to the Private Placement will be subject to a four-month hold period.

Namibia Rare Earths and its insiders are at arm's length with Gecko Namibia and there are no finder's fees payable in connection with the Property Acquisition or the Private Placement.

Following the closing of the Acquisition, Gecko Namibia will nominate two members to the five-member board of Namibia Rare Earths with Gerald McConnell remaining as Chair. Pine van Wyk will be appointed Chief Executive Officer of Namibia Rare Earths based in Namibia and Donald Burton will remain as President.

The Portfolio – Diversification into Critical Metals in Namibia

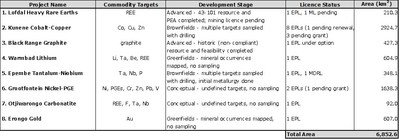

The transaction dramatically increases the Company's exposure to a wide variety of critical metals and minerals at various stages of development, providing a pipeline of projects spanning the spectrum from near-term discovery to preliminary economic assessment. All the projects are located in Namibia, a stable mining jurisdiction in which the Company has operated for the past seven years and where in-coming senior management have worked for over 20 years. This diversification will provide the Company with considerable flexibility in targeting those commodities which can provide immediate shareholder value. The strategic partnership with Gecko Namibia will allow for fast tracking to mine development as projects mature to feasibility stage. The portfolio of eight projects, their principal commodity targets and development stage are summarized in Table 1 and more fully described below. Project locations are shown in Figure 1. Total expenditures of $84,000 in year one and $422,000 in year two are required to keep the entire portfolio of properties in good standing.

1. Lofdal Heavy Rare Earth Project

In terms of project maturity, Lofdal is the most advanced with a 43-101 resource in place and completed Preliminary Economic Assessment[1]. In 2016 the Company completed an Environmental Impact Assessment and filed for an Environmental Clearance Certificate from the Ministry of Environment and Tourism, and concurrently filed for a Mining Licence with the Ministry of Mines and Energy.

2. Kunene Cobalt-Copper Project

In terms of commodity interest, the Kunene cobalt-copper project will be assigned highest priority given the high level of investor interest in cobalt and current high cobalt prices. The Kunene project builds upon the recent exploration success led by Dr. Rainer Ellmies (General Manager, Gecko Exploration) to explore for "copper belt" style deposits in northern Namibia. This work led to the first recorded discovery of Copperbelt-type stratabound cobalt-copper mineralization in Namibia in a sedimentary horizon termed the dolomite ore formation ("DOF"). The mineralization is uniformly 5 to 10 meters thick, stratabound within a dolomitic shale horizon, and averages around 0.5% copper and 1000-2000 ppm cobalt. The initial discovery is currently under intense exploration by Celsius Resources (ASX:CLA) including a 15,000 meter drill program to complete a maiden JORC resource estimate by February 2018. As per Celsius Resources' press release dated May 18, 2017 "Data from the first 20 holes drilled across this 11 km zone has enabled the Company to generate an Initial Exploration Target of between 33 and 41 million tonnes, grading approximately 0.13% - 0.17% cobalt and 0.45% - 0.65% copper. It is noted that the potential quantity and grade is conceptual in nature, and that there has been insufficient exploration to estimate a Mineral Resource, and it is uncertain if further exploration will result in the estimation of a Mineral Resource."

The Kunene cobalt-copper project comprises a very large area of favourable stratigraphy contiguous with the DOF discovery adjacent to the ground held by Celsius Resources. Secondary copper mineralization over a wide area points to preliminary evidence of a regional-scale hydrothermal system. Exploration targets on EPLs held in the Kunene cobalt-copper project comprise direct extensions of the DOF style mineralization to the west, sediment-hosted cobalt and copper, orogenic copper, and stratabound Zn-Pb mineralization. Most of the occurrences are likely spatially related to what Dr. Ellmies' geological team has interpreted as a large hydrothermal center termed the Steilrand hydrothermal system. There is considerable scope for further discoveries both along strike of the Celsius discovery and in equivalent stratigraphy elsewhere on the property. Initial investigations will trace the western extension of the DOF which may continue for over 10 km in the project area, and will follow up on numerous copper-cobalt targets drilled in the past but never analysed for cobalt.

3. Black Range Graphite Project

The Black Range flake graphite prospect was discovered in the late 1980's and was explored by Rossing Uranium Ltd. between 1988 and 1992. Rossing interpreted the graphite horizon in a fold structure with a total strike length of about 8 km. Based on 3,821 m of percussion drilling and 3,931 m of diamond drilling from a 1 km segment of the horizon, employing a cut-off grade of 2% graphitic carbon and using the polygonal section method, an historical estimate of 12.46 MT grading 4.63% graphitic carbon was utilized by Rossing to assess the project (reference "The Black Range Graphite Deposit, Feasibility Study Final Report" dated August 1992). This historical estimate does not cite reference to CIMM Definition Standards on Mineral Resources and Mineral Reserves. Additional drilling and sampling will be required to validate the historic database. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves and this historical estimate is not being treated as a current mineral resource or mineral reserve. Preliminary mining plans were drawn up and preliminary metallurgical work was carried out by Mintek of South Africa but the project was terminated before the flowsheet was fully optimized when the decision was made to focus instead on the graphite deposit at Okanjande. Okanjande was brought into production in 2017 by Gecko Namibia in a joint venture with Imerys.

There has been insufficient exploration at Black Range to estimate a Mineral Resource, and it is uncertain if further exploration will result in the estimation of a Mineral Resource or the development of an economically viable mining operation. The data cannot be used in its present form for reporting under JORC or NI 43-101, however a similar problem was encountered at Okanjande and was addressed by a program of twinning of old drill holes and assaying of the core with full QAQC. That work largely validated the Rossing work, so it should not be necessary to re-drill all the holes at Black Range. The near-term focus will be on metallurgical test work and, with a viable flowsheet, the project could be taken rapidly to a PEA stage.

4. Warmbad Lithium Project

The Warmbad project is located in southern Namibia near the South African border in an area of historic small-scale pegmatite mining known as the Tantalite Valley. The Tantalite Valley pegmatites have been mined since about 1946 for beryl, columbite-tantalite, lithium and bismuth minerals. Mining has been re-activated by Kennedy Ventures Plc who control African Tantatite (Pty) Ltd. and are producing concentrates of >40% Ta2O5 being sold into global markets. Initial production of 20M tpa concentrate is ramping up to 120M tpa. An initial lithium resource estimate is being prepared by MSA Group for early 2018 following the sampling of lepidolite bearing pegmatites grading >1.6% Li2O. The mineralization hosted on the Kennedy Ventures Pic property is not necessarily indicative of the mineralization hosted on the Warmbad Lithium Project.

The Warmbad EPL covers 605 km2 and hosts three pegmatite occurrences of undetermined extent from government maps. There are no records of any systematic exploration over the EPL. The area has recently been mapped by the Geological Survey of Namibia and the Council of Geosciences (South Africa) which has provided updated geological information. A key result of the mapping campaign is the delineation of previously unknown extensive pegmatite swarms of up to 13 km strike length. None of these pegmatites have ever been sampled and assayed. This new data will be utilized to undertake systematic sampling of the pegmatites.

5. Epembe Tantalum-Niobium Project

Epembe is an advanced stage exploration project with a well-defined, very large multiphase carbonatite dyke that has been mapped and sampled at surface over a strike length of 10 kilometers of which at least 7 km of strike length is mineralised. Gecko Namibia has completed detailed mapping and over 11,000 meters of drilling on the dyke, with preliminary mineralogical and metallurgical studies. The carbonatite contains variable concentrations of pyrochlore which is unusually enriched in tantalum. The other commodities of interest are niobium (hosted in pyrochlore) and apatite. Drilling covered only 15% of the pyrochlore hosting carbonatite. Grades of the drilled portion of the carbonatite average on the order of 150 ppm Ta2O5, 1,300 ppm Nb2O5 and 2.4% P2O5. Initial sorting tests (XRT) indicate the potential for significant physical upgrading. Planned work will focus on improving grade by optimizing XRT sorting and investigating amenability to XRF sorting. Further work will be undertaken to explore for extensions of mineralized zones along strike and at depth.

6. Grootfontein Nickel-PGE Project

Grootfontein is an early stage conceptual target based on geophysical and historical evidence for a large buried mafic-ultramafic intrusive complex. It is a poorly explored geological complex due to the extensive coverage with Kalahari sands and calcrete.

Based on historic drill holes and airborne magnetic survey interpretations, Grootfontein constitutes a huge mafic complex covering 360 km2 with the potential to host magmatic nickel, copper, vanadium, platinum group elements and chromite mineralisation as cumulates or late magmatic disseminations and stockworks. Previous work by Ongopolo Mining proved that the main intrusive phases are depleted in nickel and copper. The metals were likely fractionated as sulphides during the intrusive phase, gravitationally accumulated in the magma and intruded in the adjacent, preexisting rocks. As in other mafic hosted copper-nickel deposits such as Norilsk and Voisey's Bay, sulphidization by scavenging of sulphur from country rocks and tectono-magmatic concentration of the sulphide-rich melts are the key for the formation of this type of magmatic copper nickel deposits. Only two shallow drill fences (total of 1,386 m) were drilled by Anglo American in 1988 leaving 55 km of strike length untested.

There is also potential for zinc-lead-vanadium mineralisation of the Berg Aukas type where dolomite-hosted deposits bordering the mafic complex, which according to historical records, produced 1.6 MT of ore grading 16.77% Zn, 4.04% Pb and 0.93% V2O5 during the period 1967-1975.

7. Otjiwarongo Carbonatite Project

Otjiwarongo is another early stage conceptual target based on remote sensing data in proximity to known alkaline intrusive complexes, most notably the Okorusu complex which hosts the Okorusu fluorspar deposits. The area of interest is completely hidden by cover. The circular anomaly measures one kilometer in diameter and can be easily tested by drilling to determine if in fact a carbonatite body is the source and what styles of mineralization might be associated with it (fluorspar, rare earths, tantalum, niobium etc.).

8. Erongo Gold Project

The Erongo gold project covers an area of over 600 km2 within the Navachab-Ondundu gold trend. There are numerous mineral occurrences within the project area including at least two gold occurrences. The area has been prospected but not systematically explored. Potential targets include skarn and greisen gold-(copper-bismuth) and tin-tungsten mineralization; pegmatites formed during the late Damaran orogeny hosting lithium minerals and semi-precious stones and structurally controlled gold mineralisation. Historical figures indicate small scale mining for all of those deposit types on the property.

Project Management Strengthened – Operational Experience Focused on Namibia

Operations in Namibia for all projects will continue under Namibia Rare Earths (Pty) Ltd., the Namibian operating company of Namibia Rare Earths. Project management will be streamlined through utilization of Gecko Namibia's in-country administrative and service and the appointment of Pine van Wyk as Chief Executive Officer.

Pienaar-Schalk (Pine) van Wyk (NHD Met. Eng. B.Com, MBA), Managing Director of Gecko Namibia will be appointed Chief Executive Officer of Namibia Rare Earths based out of Namibia. Pine joined Gecko in 2008 bringing over 25 years of extensive process and project management experience to the Gecko Group. Prior to joining Gecko Namibia he worked for Rossing Uranium as Engineering Manager and later with Paladin Energy at the Langer Heinrich uranium mine where he held the positions of Operations Manager and Business Development Manager. As Managing Director for Gecko Namibia, Pine has developed a strong network of contacts throughout the mining sector and with government agencies in Namibia. In addition to his professional qualifications as a Metallurgical Engineer from Tshwane University of Technology (Pretoria), Pine holds a Bachelor of Commerce from the University of South Africa and Masters of Business Administration from University of Bloemfontein with a focus on project management.

About Gecko Namibia – A Strategic Partner

Gecko Namibia is a private, Namibian-owned, fully integrated exploration and mining company with diversified interests in Namibia. Headquartered in Windhoek, the company and its subsidiaries operate with a work force of 327 employees with a professional management team of 24 people dedicated to every stage of mineral resource development including exploration, mining, mineral beneficiation and processing, and the provision of mine services (drilling, blasting, laboratories, plant construction, processing and contract mining).

Gecko Namibia and its sister company Genet South Africa (Pty) Ltd. ("Genet") were founded by Kobus Smit who is the Chairperson of both groups. Genet is a similar resource focused company providing mining and mineral processing services in South Africa with 703 employees and a team of 20 professional managers. Genet Mineral Processing introduced an innovative dry process, using air clarification to upgrade coal for the South African market, including to clients like Exxaro and Eskom. Mr. Smit's entrepreneurial spirit has led to the establishment of a diversified portfolio of business interests that include some of the most valuable mining and tourism assets in private ownership within the Southern African region. The group also employs 285 people in its various tourism related businesses.

Most notably, in 2003 Mr. Smit and his partners established a new coal mining company, namely Umcebo Mining, which grew into a significant coal producer in South Africa with annual production of approximately 9MT. Over a period, 7 coal mines were developed as greenfield projects, all with in-house capacity. The success of Umcebo was mainly the result of innovative technology in coal processing developed in-house that gave Umcebo Mining a significant competitive advantage over other coal producers. In 2011 Glencore acquired a 41% share in Umcebo Mining. Umcebo Mining was valued R2.2 billion at that time. During 2017, Mr. Smit disposed of all his interest in Umcebo Mining in order to focus on the expansion of his business interests in Namibia.

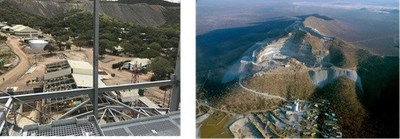

Graphite Mine in Production

Gecko Namibia was instrumental in bringing the 500,000 tpa run of mine Okanjande Graphite Mine into commercial production in 2017 through a joint venture partnership with Imerys, a global leader in the production of mineral-based, high value specialty products. Gecko Namibia re-designed a portion of the crushing, milling and flotation facilities at the Okorusu Mine for graphite processing of up to 20 000 tpa of graphite concentrate.

Fluorspar Mine and Processing Facilities

Gecko Namibia acquired all the mine and processing facility assets of the Okorusu Fluorspar Mine from Solvay in 2016. A comprehensive test program has been developed with the objective of re-opening the fluorspar operations at Okorusu. Okorusu produced close to 1.8 million tons of fluorspar concentrates over a 27-year period between 1998-2014, when Solvay made the corporate decision to close down its global mining division.

Various Salts and Limestone Operations

Gecko Salt, a subsidiary of Gecko Namibia, operates a small-scale salt production plant located approximately 120 kilometers north of the coastal town of Swakopmund. The project is currently operating at a rate of 200,000 tpa and targeting to increase to 1,000,000 tpa. The first shipment of 25,000 t of salt for the North American market was exported in August 2017.

An internal assessment has been completed over portions of the Otjivalunda salt pans, located north of Etosha National Park, which comprise natural deposits of burkeite, thenardite and sodium sulphate. Gecko Salt intends to initially produce approximately 100,000 tpa of sodium sulphate as well as washing powder, soap and other salt products for sale into the South African market.

An internal resource of 5 million tons of high-quality white marble with >98% calcium carbonate has been defined by drilling near Swakopmund together with an internal resource in excess of 25 million tons of calcitic marble rock for a calcining project. An Environmental Impact Assessment for the project has been completed and the company has received the Environmental Clearance Certificate.

Industrial Corporate Vision

Gecko Namibia envisions substantial industrial growth for Namibia, in part through the realization of its multi-faceted resource portfolio. To this end, Gecko Namibia has initiated two high level projects related to industrial development in the Swakopmund-Walvis Bay area.

An application for the development of a 200 ha industrial park named Nonidas Industria to be located 11km east of Swakopmund is at an advanced stage. The site is uniquely situated between the B2 National Highway and the main TransNamib railway leading inland from Walvis Bay and Swakopmund. The Vision Industrial Park (VIP) is a much larger concept that has been proposed by Gecko Namibia to develop a new deep-water port with an associated industrial development zone to be situated 25 km north of Swakopmund. The Namibian Cabinet awarded Gecko Namibia the right to develop a private port together with 700 ha of industrial land for the development of chemical and mining related industries. The port will be designed to accommodate Panama size vessels and have the capacity to handle 5-10 million tons of cargo volume per annum. The concept is very similar to the Coega Project of South Africa where an industrialized development zone was created with a dedicated port facility in 2009. Since its inception, Coega has attracted 54 industrial firms that have brought in over R30 billion in investments.

Donald M. Burton, P.Geo. and President of Namibia Rare Earths Inc., is the Company's Qualified Person and has reviewed and approved this press release.

About Namibia Rare Earths Inc.

Namibia Rare Earths Inc. is focused on the accelerated development of the Lofdal Rare Earths Project and on building a critical metals portfolio in Namibia. The common shares of Namibia Rare Earths Inc. trade on the TSX Venture Exchange under the symbol "NRE".

Web site: www.NamibiaRareEarths.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The foregoing information may contain forward-looking information relating to the future performance of Namibia Rare Earths Inc. Forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

| 1 Preliminary Economic Assessment on the Lofdal Rare Earths Project Namibia dated October 1, 2014 authored by David S. Dodd, B. Sc (Hon) FSAIMM - The MDM Group, South Africa, Patrick J.F. Hannon, M.A.Sc., P.Eng. and William Douglas Roy, M.A.Sc., P.Eng. - MineTech International Limited, Canada, Peter Roy Siegfried, MAusIMM (CP Geology) and Michael R. Hall, B.Sc (Hons), MBA, MAusIMM, Pr.Sci.Nat, MGSSA - The MSA Group, South Africa |

|

SOURCE Namibia Rare Earths Inc.

Namibia Rare Earths Inc., Don Burton, President, Tel: +01 (902) 835-8760, Fax: +01 (902) 835-8761, Email: [email protected]

Share this article