RBC first bank in Canada to launch a personalized, AI-powered budget solution through award-winning mobile app Français

Clients can use NOMI Budgets to automatically analyze their spending and recommend personalized budgets

TORONTO, April 25, 2019 /CNW/ - Creating and sticking to a budget is key to financial success, but it can also result in feelings of stress and anxiety for many Canadians. To bring ease and convenience to managing finances and developing budgets, RBC launches NOMI Budgets, a new solution available through the RBC Mobile app. A first-of-its-kind in Canada, NOMI Budgets uses artificial intelligence (AI) to proactively analyze a customer's spending history, recommend an appropriate budget and send timely updates to help keep them on track in a seamless and convenient way.

"We know that so many of our clients look for helpful tools and support when it comes to budgeting and managing their day-to-day finances," said Peter Tilton, Senior Vice-President, Digital at RBC. "NOMI Budgets is the latest of our personalized digital capabilities that, using the power of AI, provides our clients with deeper insights that can increase their financial confidence."

How it Works

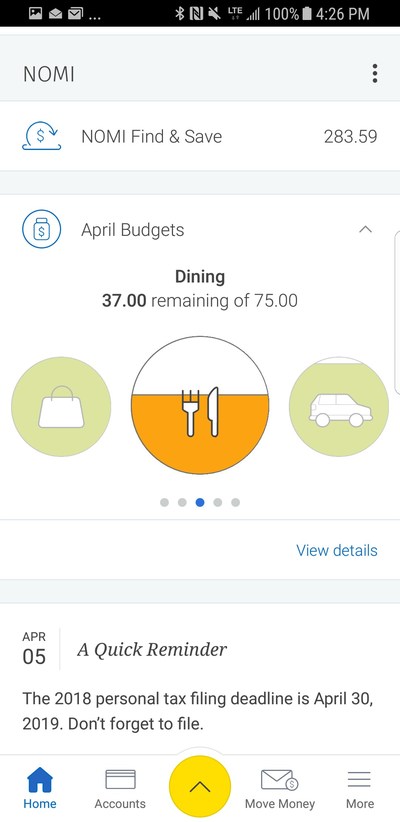

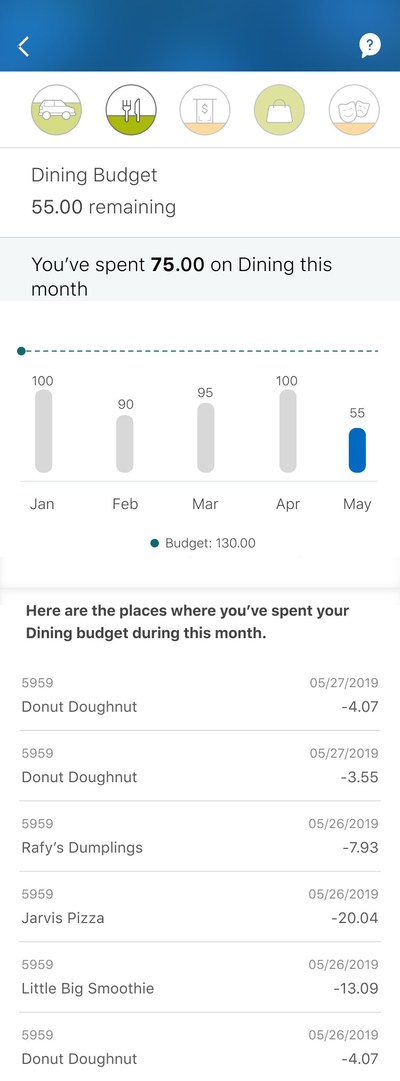

While clients are busy living their lives, NOMI Budgets keeps an eye on their finances and tracks their spending habits. Providing a simple customer experience, this new feature eliminates the need for people to classify transactions, scan any receipts or monitor each spend as it does all of the hard work automatically. Powered by NOMI Insights, NOMI Budgets will recommend a personalized, monthly budget in one of five key areas – Entertainment, Shopping, Cash Withdrawals, Transportation and Dining – based on noticing an increase in spend over the last month, compared to previous months. Clients can easily adjust the recommended budgets should they wish to make changes. To help keep clients on track, NOMI Budgets will notify them when they reach 50%, 75% and 100% of their budget.

"Our NOMI capabilities have been developed to help our clients manage and be more mindful of their finances," said Rami Thabet, Vice-President, Digital Product at RBC. "The advancements that we've made in AI technology enable our customers to receive financial insights, savings and personalized budgets with ease, and we're quickly seeing the value that these solutions provide to so many people."

RBC and Digital Innovation

NOMI blends AI and client data with a highly personal touch to identify trends, unusual activity and potential savings opportunities that help clients manage their day-to-day finances through the RBC Mobile app. NOMI Budgets is the newest addition to the NOMI family, which includes:

- NOMI Insights: Provides personalized financial insights, timely tips and advice to help with day-to-day finances.

- NOMI Find & Save: Proactively analyzes spending behaviours to find extra money that won't be missed, and automatically sets it aside as savings. As of February 2019, NOMI Find & Save clients have saved more than $83 million, with active users saving an average of $180 per month.

The RBC Mobile app is available for free download from the App Store on iPhone and iPad or at www.AppStore.com. For more information about the RBC Mobile app, please visit www.rbcroyalbank.com/mobile.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 84,000+ employees who bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada's biggest bank, and one of the largest in the world based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our 16 million clients in Canada, the U.S. and 33 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-sustainability.

SOURCE RBC Royal Bank

Media Contact: Julia Miller, RBC Communications, 416-917-8451, [email protected]

Share this article