Engages CRU to Confirm Value-in-Use Analysis of RNC's Concentrate Roasting Approach for Dumont High Grade Nickel-Cobalt Concentrate

TORONTO, March 1, 2018 /CNW/ - RNC Minerals ("RNC") (TSX: RNX) is pleased to provide an update on value enhancement initiatives related to the Dumont Nickel-Cobalt Project. CRU has been engaged to complete a value-in-use and market value analysis of the nickel-cobalt concentrate expected to be produced by the Dumont Nickel-Cobalt Project.

"RNC is in the enviable position that, in addition to being the largest undeveloped nickel and cobalt reserve in the world, the Dumont Nickel-Cobalt Project is expected to produce the highest-grade nickel and cobalt sulphide concentrate in the world,1 providing maximum flexibility for potential partners and offtake parties from a wide range of nickel consuming sectors, including the battery and stainless steel markets. As highlighted by Cobalt 27 in its recent announcement, Dumont concentrate is 'ideal for producing nickel and cobalt material feed to be sold directly into the battery industry,"2 said Mark Selby, President and CEO of RNC Minerals.

Selby continued, "It is RNC's roasting approach that allows nickel concentrate to be utilized by a wide range of nickel consumers, including very large scale integrated NPI/stainless plants that convert feed into finished product at higher recoveries and at significantly lower processing costs, resulting in expected payabilities much higher than the 70-75% payability recently available in the nickel concentrate market. We look forward to the value-in-use analysis from CRU to confirm the market value of Dumont's nickel-cobalt concentrate."

| 1. |

Source: Wood Mackenzie (See Tables 1 and 2 below) |

| 2. |

Source: Cobalt 27 Capital Corp. news release dated February 22, 2018 |

Alternate Roasting Process

RNC successfully completed a bulk concentrate test in early 2016 and, in co-operation with one of the leading Japanese trading houses, successfully delivered roasted concentrate samples to multiple potential end users across Asia and Europe utilizing RNC's alternate roasting approach.

RNC believes that market prices over the last several years from traditional nickel smelters and refiners results in the concentrate producer receiving approximately 70-75% of the contained value of the nickel in the concentrate, allowing the smelter/refiner to capture 25-30% of the concentrate value less their operating costs and recovery.

After successfully demonstrating the potential of roasted nickel concentrate as a more valuable alternative to traditional smelting and refining in 2011, RNC worked with the Tsingshan Group ("Tsingshan"), beginning in 2012, to validate the concept. In 2014, Tsingshan began construction of the first plant to directly utilize nickel sulphide concentrate as part of the stainless steel making process and has since built an additional plant utilizing the roasted nickel concentrate process. Additionally, Tsingshan signed an offtake deal with Western Areas Ltd. in late 2016. RNC believes Tsingshan's successful use of roasted nickel concentrate in their production facilities in China is an important development for the nickel market.

RNC's work with one of the large Japanese trading houses indicates that roasters in Asia are able to process feed at an approximate cost of $30/tonne. When combined with the average integrated NPI/stainless conversion cost of approximately $80-$90/tonne (according to Wood Mackenzie), the implied conversion cost is approximately $110-$120/tonne of concentrate (equivalent to approximately $400 per tonne of contained nickel for a 29% concentrate or approximately 3% of the current LME price of $13,800 per tonne). This compares very favourably to the 25-30% of the concentrate value believed to be currently captured by traditional smelters/refiners. The CRU value-in-use study will be used to estimate the terms that roasting market participants would require to be willing to process the nickel-cobalt concentrate expected to be produced by Dumont as compared to these current market benchmarks.

Note: dollar amounts referred to above are US$.

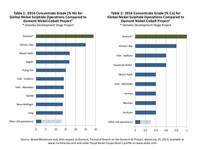

Table 1: 2016 Concentrate Grade (% Ni) for Global Nickel Sulphide Operations Compared to Dumont Nickel-Cobalt Project1

(*Denotes Development Stage Project)

| Rank |

Operation / Project |

Concentrate |

Ownership (main) |

Location |

| 1 |

Dumont* |

29% |

RNC / Waterton |

Canada |

| 2 |

Voisey's Bay |

25% |

Vale |

Canada |

| 3 |

Mount Keith |

17% |

BHP |

Australia |

| 4 |

Raglan |

17% |

Glencore |

Canada |

| 5 |

Flying Fox |

15% |

Western Areas |

Australia |

| 6 |

Vale Sudbury |

14% |

Vale |

Canada |

| 7 |

Vale Manitoba |

14% |

Vale |

Canada |

| 8 |

KGHM Sudbury |

14% |

KGHM |

Canada |

| 9 |

Nova-Bollinger |

14% |

Independence Group |

Australia |

| 10 |

Long |

14% |

Independence Group |

Australia |

| 11 |

Other (19 operations) |

2.6 – 13% |

Table 2: 2016 Concentrate Grade (% Co) for Global Nickel Sulphide Operations Compared to Dumont Nickel-Cobalt Project1

(* Denotes Development Stage Project)

| Rank |

Operation / Project |

Concentrate |

Ownership (main) |

Location |

| 1 |

Dumont* |

1% |

RNC / Waterton |

Canada |

| 2 |

Voisey's Bay |

0.8% |

Vale |

Canada |

| 3 |

Vale Sudbury |

0.6% |

Vale |

Canada |

| 4 |

Savannah Nickel |

0.6% |

Panoramic Resources |

Australia |

| 5 |

Mount Keith |

0.4% |

BHP |

Australia |

| 6 |

Vale Manitoba |

0.4% |

Vale |

Canada |

| 7 |

Kevitsa |

0.4% |

Boliden |

Finland |

| 8 |

Nkomati |

0.4% |

ARM |

South Africa |

| 9 |

Jinchuan |

0.4% |

Jinchuan |

China |

| 10 |

Other (10 operations) |

0.1 – 0.3% |

| 1. |

Source: Wood Mackenzie and, with respect to Dumont, Technical Report on the Dumont Ni Project, dated July 25, 2013, available at www.rncminerals.com and under Royal Nickel Corporation's profile on www.sedar.com |

To view Tables 1 and 2 in chart format please click this link

Dumont Highlights:1

- World's largest undeveloped nickel reserve and cobalt reserve.

- Large scale, long life nickel and cobalt production - 33-year life with over 1 billion tonnes of reserves. Potential for much longer life/future expansions from equally large resource.

- Initial annual production of 33 ktpa (73 million pounds) of nickel and 1.0 ktpa of cobalt (2.3 million pounds) contained in concentrate.

- Expanded in year five to an annual average of 51 ktpa (113 million pounds) of nickel and 2.0 ktpa of cobalt (4.3 million pounds).

- World's highest grade nickel (29%) and cobalt (1%) sulphide concentrate - suitable for feed to both the stainless steel and battery market.

- Dumont proven and probable reserves consist of 1.18 billion tonnes of ore containing 3.15 million tonnes of nickel (6.9 billion pounds) and 126,000 tonnes (278 million pounds) of cobalt.2

- Shovel-ready: feasibility study and permitting complete. Strong community support.

- Conventional open pit, mine-mill operation using proven sulphide flotation.

- Structurally low-cost operation: significant infrastructure in place, low strip ratio (1.1:1).

- Excellent jurisdiction: Abitibi region of Quebec with significant labour and capital infrastructure.

- Significant additional value potential from the roasted nickel concentrate approach advanced by RNC.

- RNC currently has a 50% interest in the nickel joint venture (with Waterton Global Resource Management ("Waterton")) that owns Dumont.

| 1. |

See "Dumont Nickel Project NI 43-101 Compliance" statement below. |

| 2. |

Reference is made to table 15-1 in section 15 of the Technical Report on the Dumont Ni Project, dated July 25, 2013, available at www.rncminerals.com and under Royal Nickel Corporation's profile on www.sedar.com. |

Dumont Nickel Project NI 43-101 Compliance

Unless otherwise indicated, RNC has prepared the technical information contained in this news release ("Technical Information") based on information contained in the feasibility study dated July 25, 2013 relating to the Dumont Nickel-Cobalt Project available under RNC's company profile on SEDAR at www.sedar.com. The feasibility study was prepared by or under the supervision of a qualified person (a "Qualified Person") as defined in NI 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. Readers are encouraged to review the full text of the feasibility study which qualifies the Technical Information. Readers are advised that mineral resources that are not mineral reserves do not have demonstrated economic viability. The feasibility study is intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the feasibility study.

The Technical Information in this news release has been reviewed by Alger St-Jean, P. Geo., Vice President Exploration of RNC and Johnna Muinonen, Vice President Operations of RNC, with respect to the Dumont Nickel-Cobalt Project, both Qualified Persons under NI 43-101.

About RNC Minerals

RNC is a multi-asset mineral resource company with a portfolio of nickel, cobalt, and gold production and exploration properties. RNC has a 50% interest in a nickel joint venture with Waterton that owns the Dumont Nickel-Cobalt Project located in the Abitibi region of Quebec which contains the second largest nickel reserve and eighth largest cobalt reserve (the largest undeveloped nickel and cobalt reserves in the world). RNC has a 100% interest in the producing Beta Hunt gold and nickel mine located in Western Australia. RNC has a strong management team and Board with over 100 years of mining experience at Inco and Falconbridge. RNC's common shares trade on the TSX under the symbol RNX. RNC shares also trade on the OTCQX market under the symbol RNKLF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of RNC, production guidance and the potential of the Beta Hunt and Reed mines as well as the and the potential of the Dumont development project and Qiqavik, West Raglan, Jones-Keystone Loflin and Landrum-Faulkner exploration properties.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of RNC to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to RNC's filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although RNC has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and RNC disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

SOURCE RNC Minerals

Rob Buchanan, Director, Investor Relations, T: (416) 363-0649, www.rncminerals.com

Share this article