Superior Gold Inc. Announces High Grade Gold Mineralization up to 150 Metres Northwest of Known Indian Mineralization

INTERSECTIONS INCLUDE 27.9 G AU/T OVER 4.10 METRES, 22.2 G AU/T OVER 2.60 METRES, AND 57.7 G AU/T OVER 0.75 METRES

(In US Dollars unless otherwise stated)

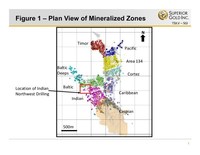

TORONTO, Feb. 10, 2020 /CNW/ - Superior Gold Inc. ("Superior Gold" or the "Company") (TSXV:SGI) is pleased to announce results from the ongoing underground diamond drill program focused on reserve and resource expansion at its 100%-owned Plutonic Gold mine in Western Australia. The drilling targeted potential extensions to the gold mineralization within the Indian Zone.

Results are provided for 14 drill holes for a total of more than 2,600 metres of drilling.

KEY FINDINGS

- 19 intersections encountered more than 5g Au/t

- 13 intersections encountered more than 10g Au/t

- 7 intersections encountered more than 25g Au/t

- 5 intersections encountered more than 50g Au/t

The drilling was focused on the area to the northwest of the Indian Zone within an area which extends approximately 500 metres between the Indian and Baltic Zones and which has not been tested.

The location of this drilling is shown in Figures 1-3. All intersections are shown in Table 1 below. Reported intersections are over a minimum downhole width of 0.30 metres (0.20 metres true width).

Chris Bradbrook, President and CEO of Superior Gold stated: "We are very pleased with these drill results, which we believe illustrate the potential to connect the Indian and Baltic Zones. The drilling was completed over a strike length of more than 150 metres and a vertical extent of more than 100 metres. Mineralization remains open both up and down dip and along strike. The Indian and Baltic Zones are key components of the recently announced five year underground Life of Mine ("LOM") plan that was announced in October 2019, and consequently, these results illustrate the potential to extend this plan beyond five years. We will continue to release drill results in some of the the other key areas of the LOM plan, including Timor, Indian and Baltic in the near future."

HIGHLIGHTS

Intersections are summarized in Table 1 below:

Drill Hole |

Easting |

Northing |

Drill hole |

Dip |

Azimuth |

End of |

Downhole |

Downhole |

Downhole |

Au |

Est True |

UDD21655 |

3771 |

11633 |

1042 |

-37 |

130 |

171 |

130.00 |

133.80 |

3.80 |

4.9 |

3.5 |

Including |

132.00 |

132.70 |

0.70 |

19.2 |

0.5 |

||||||

145.50 |

147.40 |

1.90 |

8.0 |

1.3 |

|||||||

Including |

146.50 |

147.40 |

0.90 |

14.4 |

0.6 |

||||||

151.30 |

156.30 |

5.00 |

6.8 |

3.5 |

|||||||

164.20 |

164.75 |

0.55 |

4.9 |

0.4 |

|||||||

UDD21656 |

3775 |

11633 |

1042 |

-47 |

128 |

178 |

123.50 |

127.60 |

4.10 |

27.9 |

2.9 |

Including |

123.50 |

125.00 |

1.50 |

73.2 |

1.1 |

||||||

140.70 |

150.60 |

9.90 |

3.9 |

6.9 |

|||||||

Including |

144.15 |

146.50 |

2.35 |

11.9 |

1.6 |

||||||

UDD21657 |

3770 |

11632 |

1042 |

-33 |

137 |

174 |

No Significant Intersections |

||||

UDD21658 |

3774 |

11632 |

1042 |

-40 |

146 |

165 |

139.30 |

139.70 |

0.40 |

4.2 |

0.3 |

141.85 |

142.60 |

0.75 |

57.7 |

0.5 |

|||||||

147.00 |

147.45 |

0.45 |

4.6 |

0.3 |

|||||||

UDD21659 |

3770 |

11632 |

1042 |

-32 |

157 |

179 |

124.20 |

125.30 |

1.10 |

7.3 |

0.8 |

161.00 |

161.50 |

0.50 |

4.7 |

0.4 |

|||||||

UDD21660 |

3770 |

11632 |

1042 |

-45 |

160 |

171 |

68.90 |

69.90 |

1.00 |

38.6 |

0.7 |

136.80 |

139.30 |

2.50 |

5.0 |

1.8 |

|||||||

UDD21661 |

3770 |

11632 |

1042 |

-56 |

165 |

156 |

121.50 |

122.40 |

0.90 |

4.3 |

0.6 |

130.30 |

131.80 |

1.50 |

5.7 |

1.1 |

|||||||

UDD21662 |

3769 |

11632 |

1042 |

-29 |

178 |

211 |

148.65 |

151.50 |

2.85 |

11.3 |

2.0 |

Including |

148.65 |

149.20 |

0.55 |

4.4 |

0.4 |

||||||

and |

150.95 |

151.50 |

0.55 |

53.8 |

0.4 |

||||||

UDD21663 |

3769 |

11632 |

1042 |

-35 |

185 |

226 |

136.20 |

137.00 |

0.80 |

15.0 |

0.6 |

147.60 |

148.10 |

0.50 |

6.4 |

0.4 |

|||||||

UDD21664 |

3769 |

11632 |

1043 |

-10 |

190 |

450 |

No Significant Intersections |

||||

UDD21665 |

3775 |

11633 |

1042 |

-37 |

122 |

168 |

No Significant Intersections |

||||

UDD21666 |

3769 |

11632 |

1042 |

-23 |

175 |

203 |

147.10 |

148.00 |

0.90 |

54.3 |

0.6 |

Including |

154.10 |

156.70 |

2.60 |

22.2 |

1.8 |

||||||

and |

154.10 |

154.70 |

0.60 |

93.5 |

0.4 |

||||||

UDD21667 |

3771 |

11632 |

1042 |

-56 |

135 |

171 |

119.30 |

120.10 |

0.80 |

3.1 |

0.6 |

122.10 |

123.10 |

1.00 |

4.0 |

0.7 |

|||||||

UDD21668 |

3775 |

11633 |

1042 |

-50 |

121 |

174 |

No Significant Intersections |

||||

Qualified Person

Scientific and technical information in this news release has been reviewed and approved by Keith Boyle, P.Eng., Chief Operating Officer of the Company, who is a "qualified person" as defined by National Instrument 43-101 (NI 43-101)

Quality Control Protocols

Core is drilled BTW core diameter (42 mm). Core intervals are whole core sampled. All gold results were determined by ALS Minerals (Perth) using fire assay fusion (40g charge, lead collection method) with an ICP finish. Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards, blanks and duplicates are included in approximately every 20 samples for Quality Assurance/Quality Control purposes by the Company as well as the laboratory. Approximately 5% of sample pulps are sent to secondary laboratories for check assays.

Settlement of Consultant Services

The Company also announces that it has agreed to issue an aggregate of 152,000 Common Shares at C$0.71 per Common Share (the "Issue Price") to settle debt in the amount of C$107,920 owing to two consultants for services rendered to the Company's wholly-owned subsidiary, Billabong Gold Pty Ltd ("Billabong") (the "Share Issuances"). The Issue Price was calculated by using the volume weighted average price for the Common Shares for the five trading days immediately prior to January 28, 2020. The Share Issuances will be subject to the terms of certain shares for services agreements entered into by and among the Company, Billabong and each of the consultants (the "Agreements"). Pursuant to the Agreements, it was agreed that the debt owing for the services would be settled by a combination of cash and issuance of Common Shares and the Share Issuances represent the portion of the debt which was to be settled by issuance of Common Shares to the consultants.

The Share Issuances have been approved by TSX Venture Exchange. All Common Shares issued in connection with the Agreements will be subject to a four month and one day hold period under applicable Canadian securities laws.

About Superior Gold

Superior Gold is a Canadian based gold producer that owns 100% of the Plutonic Gold operations located in Western Australia. The Plutonic Gold operations include the Plutonic underground gold mine and central mill, the Hermes open pit projects and an interest in the Bryah Basin joint venture. Superior Gold is focused on expanding production at the Plutonic Gold operations and building an intermediate gold producer with superior returns for shareholders.

Forward Looking Information

This press release contains "forward-looking information" within the meaning of applicable securities laws that is intended to be covered by the safe harbours created by those laws. "Forward-looking information" includes statements that use forward-looking terminology such as "may", "will", "expect", "anticipate", "believe", "continue", "potential" or the negative thereof or other variations thereof or comparable terminology.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made. Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. See "Risk Factors" in the Company's prospectus dated February 15, 2017 filed on SEDAR at www.sedar.com for a discussion of these risks.

The Company cautions that there can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information. Except as required by law, the Company does not assume any obligation to release publicly any revisions to forward-looking information contained in this press release to reflect events or circumstances after the date hereof.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Superior Gold

Superior Gold Inc.: Brian Szeto, Vice President, Corporate Development and Kate Stark, Director of Investor Relations, [email protected], Tel: 647-925-1293

Share this article