Taxation and Families: Refining the Model - Raymond Chabot Grant Thornton Publishes an Innovative Study in Collaboration with ESG UQAM Français

Today we are releasing a survey conducted by our firm revealing that in many respects, family taxation does not reflect the reality of today's families. When families make a decision based on taxes rather than needs, there are resulting distortions that need to be adjusted. The federal and Quebec governments are invited to undertake a complete overhaul of family taxation to reflect the dynamics of today's families.

– Emilio B. Imbriglio, President and CEO

MONTRÉAL, Sept. 24, 2018 /CNW Telbec/ - Raymond Chabot Grant Thornton and the UQAM's École des sciences de la gestion (ESG UQAM) pooled their expertise to analyze family taxation under various themes. In more than 70% of the situations analyzed, the tax rules are not neutral depending on the family's social profile, the couple's legal status and the family's economic class. Canadian families often find themselves in a situation where tax considerations rather than needs determine their choices.

The authors, Luc Lacombe, Tax Services Leader and Partner at Raymond Chabot Grant Thornton, as well as Brigitte Alepin and Manon Deslandes, professors at the Département des sciences comptables in ESG UQAM also presented some considerations to overhaul Canada's tax system.

According to the authors, the governments of Quebec and Canada need to review family taxation policies sooner rather than later, because these policies undermine our tax system's equity when it comes to families and, in some cases, hamper family decisions. For example, Canadian tax measures can have a significant impact on a family's wealth creation decision. In previous years, governments established saving incentive plans such as the TFSA, RRSP, RESP and RDSP, each with different tax rules and incentives. Luc Lacombe stated: "As a result of these differences, families with limited cash resources are faced with choosing from amongst the alternative savings plans available. If they take into consideration tax rules, their decision-making process may lead them to favour alternatives that are to the detriment of their real savings needs thus limiting their financial flexibility."

Seven main areas were examined…

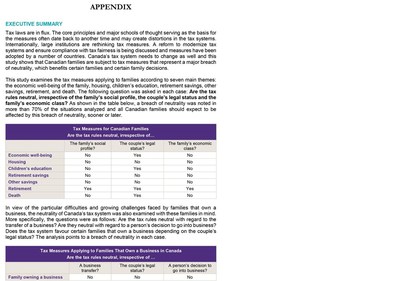

The study examines the tax measures applying to families based on seven main areas: the economic well-being of the family, housing, children's education, retirement savings, other savings, retirement, and death. The authors asked the following question in each case: Are the tax rules neutral, irrespective of the family's social profile, the couple's legal status and the family's economic class? A breach of neutrality was noted in more than 70% of the situations analyzed and all Canadian families should expect to be affected by this breach of neutrality, sooner or later.

... and Families That Own a Business

Considering the difficulties and growing challenges faced by families that own a business, the neutrality of Canada's tax system was also examined. Specifically, the questions were as follows: Are the tax rules neutral with regard to the transfer of a business? Is the tax system neutral with regard to a person's decision to go into business? Does the tax system favour certain families that own a business depending on the couple's legal status? The analysis points to a breach of neutrality in each case.

Seven suggested ideas and approaches for fairer family taxation!

To offset these distortions, the study presents ideas and approaches that could be considered as part of the overhaul of the family tax system. Among others, the authors propose the introduction of a taxation system that is based on family income rather than an individual's income, the introduction of a tax rate structure that is based on family size, the creation of a Registered General Savings Plan (RGSP), or the possibility of a rollover upon a taxpayer's death to a trust set up exclusively for a dependent child. The attached appendix provides additional details.

In 2017, the Canadian tax system marked its 100th anniversary. While tax policies may have evolved over this period, the study reveals that they have not kept up with how families are changing. The current family taxation system includes numerous breaches of neutrality that impact the decisions made by families in Quebec and Canada. "The purpose of this study is to encourage our Canadian and Quebec politicians to reflect on these major issues and undertake a review of family taxation policies," concluded Emilio B. Imbriglio, President and CEO of Raymond Chabot Grant Thornton.

To view and download the study, go to www.rcgt.com/taxation-family2018

About Raymond Chabot Grant Thornton

Founded in 1948, Raymond Chabot Grant Thornton (rcgt.com) has become a Canadian leader in the areas of assurance, tax, advisory services and business recovery and reorganization, with more than 2,500 professionals, including approximately 200 partners. Together, Raymond Chabot Grant Thornton and Grant Thornton LLP, another Canadian member firm of Grant Thornton International Ltd comprise more than 4,400 professionals and close to 170 offices across Canada to help Canadian organizations achieve their full growth potential both locally and globally. Grant Thornton International Ltd provides clients with the expertise of member and correspondent firms across more than 135 countries and more than 50,000 professionals.

SOURCE Raymond Chabot Grant Thornton

Information: Colin Danby, Director, NATIONAL, Tel.: 514-843-2355, Cell.: 514-679-1622, [email protected]; Source: Francis Letendre, Head, Public Relations , Raymond Chabot Grant Thornton, Tel.: 514-390-4201, [email protected]

Share this article